Strategies for Corporate Renewable Energy Procurement

Many companies are seeking to increase their use of renewable energy (RE). The aims are typically to reduce carbon emissions, hedge energy prices and respond to CSR drivers. High profile initiatives such as the RE100, a global collaborative initiative requiring businesses to commit to using 100% renewable electricity, are helping to accelerate the trend.

This note sets out the main options and considerations for companies looking to source renewable energy. Companies typically use a range of approaches suited to their context, available resources and level of ambition.

Key concepts – additionality and electricity attributes

A key concept for setting an appropriate strategy is that of “additionality”, a quality criterion for GHG emission reduction (carbon offset) projects stipulating that the project would not have been implemented in a baseline or “business-as-usual” scenario. In other words, additionality refers to the extent to which the option results in new renewable energy generation and thus helps further decarbonisation. This is not always easy to determine, and there is a spectrum from ‘clearly additional’ through to not additional.

As electricity is physically identical irrespective of its generation source, the industry has also developed the concept of Renewable Electricity Attributes. These are the characteristics of that electricity source that deem it renewable, for example the fuel type, location, associated GHG emissions and potentially other environmental and social impacts of the electricity generation. Attributes may be contractually defined within power purchase agreements (PPAs) or even transacted separately to physical power e.g. in the case of Synthetic PPAs and Renewable Energy Certificates as explained further below.

Strategy options

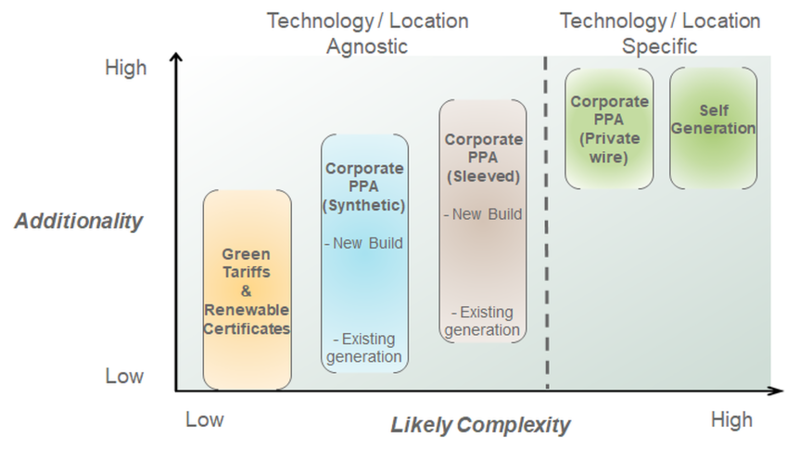

The figure below summarises the main options, indicating in general terms only, their level of additionality versus likely complexity of the option for achieving 100% renewable electricity. ‘Complexity’ refers to both the procurement process and ongoing operation in the case of the self-generation option.

Figure 1: Renewable Energy Options

The ranges of additionality reflect the diversity within each of the options. Similarly, complexity is case specific, so the axis-grading is only indicative. At one extreme, however, achieving 100% renewable through self-generation is challenging if not impossible, whereas procuring a green tariff is straightforward.

Self-generation is a robust approach from an additionality perspective, provided that the renewable attributes are retained. However, its scope is limited by local renewable energy resources, which in most cases allows it to make only a minor or partial contribution to a company’s total energy requirements. Data for RE100 member companies in Europe shows that less than 1% of their reported renewable energy came from self-generation in 2016 (1).

Substantial on- or near- site generation projects are often developed and possibly financed by third party developers, with the end user signing a power purchase agreement (PPA). This allows the end user to focus on its core business, while the renewable developer designs, builds, finances and operates the asset. This is the first of a suite of Corporate PPA options. If connected behind the site utility meter, this would be described as a ‘private wire’ arrangement, due to the avoidance of using the public distribution network, so allowing the full retail value of grid electricity to be offset.

To access quantities of renewable energy required to achieve 100% renewable energy, most companies will need to rely on off-site generation. This brings us to off-site Corporate PPAs, Green Tariffs and Renewable Certificates. Approximately 3% of reported renewable energy consumption of European RE100 member companies is through Corporate PPAs, whereas Green Tariffs account for 63% and Renewable Certificates 29% (1).

Corporate PPAs can be structured in a number of different ways. Although the UK market is one of the most active in Europe, the Corporate PPA market is still illiquid, opaque and typically short term.

Due to the structure of the electricity market, off-site Corporate PPAs need to involve at least three parties: the Consumer, Generator and the Supplier. The Supplier is needed to play a balancing role, providing a mechanism to “top-up” or “spill” any short fall or excess in renewable generation relative to the Consumer’s instantaneous demand. The structure of Corporate PPAs is the domain of specialist industry lawyers, but two models have emerged:

- A “Sleeved” Corporate PPA (or “Direct” or “Back to Back” PPA) – where the generator sells power directly to the consumer.The Consumer then has a ‘back to back’ contract with the supplier to sell and buy back the power, receiving the balancing function from the supplier that the generator is unable to provide.This is the most common contract form in the UK, perhaps because it provides a direct link between consumer and generation asset.

- A Synthetic (or “Virtual” or “Price Guarantee Arrangement (PGA)” PPA) – where the power is sold virtually by the Generator to the Consumer.The Generator sells the power to the Supplier, and there is a separate agreement for the difference between a power offtake market price and the PPA price (i.e. a form of contract for difference).This approach is popular in the US, due to the disaggregated power sector.It can be a simpler contract to procure than a sleeved PPA, as it focuses on the attributes rather than the physical generation assets. It is also more easily scalable where there are a number of generators to be contracted with.

A Green tariff is a tariff offered by an electricity supplier with some form of claimed environmental attribute. A typical green tariff implies that an electricity supplier matches electricity supplied to the Consumer with an equivalent amount from renewable generation.

Some others involve paying a premium to contribute to a fund that will be used to support new renewable energy developments. The degree of additionality depends on whether the tariff supports new or existing generation, and the contractual allocation of the attributes.

Renewable Certificates (a type of Energy Attribute Certificate) are contractual instruments that allow companies to accurately account for their renewable electricity purchases. They exist in markets with reliable tracking systems to ensure that no double counting of the attributes takes place. A uniquely identifiable certificate is issued for each MWh of renewable electricity produced. All EU member states must have a Guarantee of Origins (GoOs) scheme to track energy attributes. In the UK, they are called Renewable Energy Guarantees of Origin (REGO). REGOs may be contractual attributes within Corporate PPAs and Green Tariffs, or traded separately.

Making credible renewable electricity usage claims

Companies can make a variety of statements about their use of RE. An important distinction is whether the option is helping finance new renewable assets (covering both capex repayments and opex) or whether the assets have largely had their capex paid off so can price more competitively. The vast majority of renewable generation in the UK is still benefiting from long term ROC, FIT and CFD contracts, so fall into the latter category. Corporate PPAs and Green Tariffs with these assets improve the returns to existing asset holders, but do not help further decarbonisation. Some early green tariffs pledged to voluntarily retire a proportion of ROCs, so to provide some additionality beyond the mandatory supplier obligation, but represented a tiny fraction of the market.

To prove additionality, the option should pass this test: would the project have been built in the absence of the commercial arrangements that comprise the project / Corporate PPA / Green tariff? If the answer is no, then the Consumer has a relatively strong claim to be directly associated with the renewable output and hence be additional.

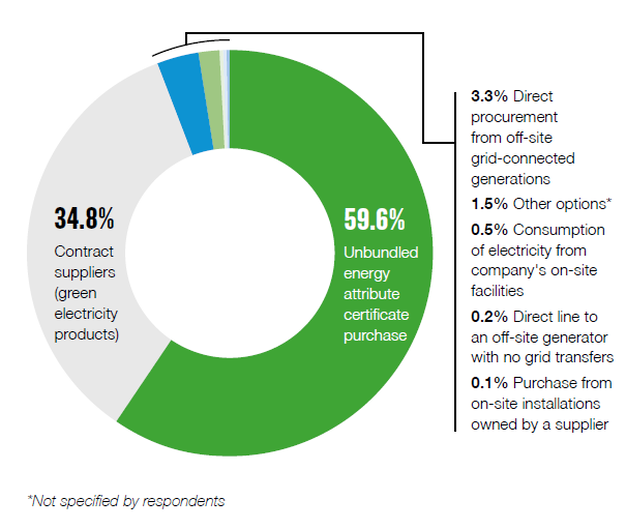

For statements about RE usage to be credible, companies need to be sure that their RE sources and purchasing mechanisms meet specific criteria. There is an emerging trend that voluntary reporting schemes, such as the Carbon Disclosure Project (CDP), are starting to distinguish between the types of renewable energy a company uses, with CDP scoring down companies who procure more than 50% of their renewable energy as opposed to self-generation. The RE 100 scheme uses six categories for reporting its members’ performance as shown in Figure 2.

The RE100 also initiative provides guidance setting out criteria for making credible claims about the contractual allocation of attributes. The criteria cover the following aspects: credible generation data, attribute aggregation, exclusive ownership (no double counting) of attributes, exclusive claims (no double claiming) of attributes, geographic market limitations of claims; and vintage limitations of claims. Further information can be found in the RE 100 publication ‘Making credible renewable electricity usage claims’(3).

Figure 2: Global Approaches to Renewable Electricity amongst RE100 member companies (Source:RE100 Annual report 2017)

Conclusion

Science based targets and the rapid decarbonisation of the power sector means that renewable energy is an increasingly important part of corporate energy strategies. Companies are also keen to obtain business benefit from renewable energy. For renewable developers, Corporate PPAs are helping the transition to post-subsidy renewables by providing bankable revenue streams.

The coexistence of subsidised and non-subsidised renewables, plus new and existing generation, means that untangling what is ‘additional’ is rarely straightforward. Companies can expect the bar to continue to rise in terms of what constitutes a credible renewable energy strategy, as stakeholders become savvier about what additionality really means.

The 2017 RE100 annual report shows that 95% of the renewable energy in Europe and a similar proportion globally is procured through Green Tariffs and Renewable Certificates. The leaders are maximising the usage of on- and near-site renewable energy, favouring self-generation and Corporate PPAs that give a clear link between the Consumer and new generation. This allows them to hedge prices and fix long term contracts for their renewable energy supply. It also allows them to stand out from the crowd from those relying on Green Tariffs and Renewable Certificates with questionable additionality.

References:

1. RE100 Progress and Insights Report, January 2018.

2. ROCS - Renewable Obligation Certificates, FiTs - Feed in Tariifs and CfD - Contracts for Differences.

3. http://media.virbcdn.com/files/62/53dc80177b9cc962-RE100CREDIBLECLAIMS.pdf