UKGBC net zero definition: false prospectus or dawn of new era?

Verco supported UKGBC’s publication of a Net Zero Carbon Buildings Framework Definition in April 2019 and helped to develop the Net zero carbon energy performance targets for offices published by UKGBC in January 2020. Here we offer our own reflections on the stringency of the targets which has been questioned by some practitioners in the field.

Two minute recapitulation

The UKGBC Framework Definition implements in the UK the WorldGBC’s global project Advancing Net Zero which aims to promote and support the acceleration of net zero carbon buildings to 100% by 2050. New buildings must target net zero in operation by 2030.

UKGBC defines net zero carbon – operational energy to be “when the amount of carbon emissions associated with the building’s operational energy on an annual basis is zero or negative. A net zero carbon building is highly energy efficient and powered from on-site and/or off-site renewable energy sources, with any remaining carbon balance offset.”

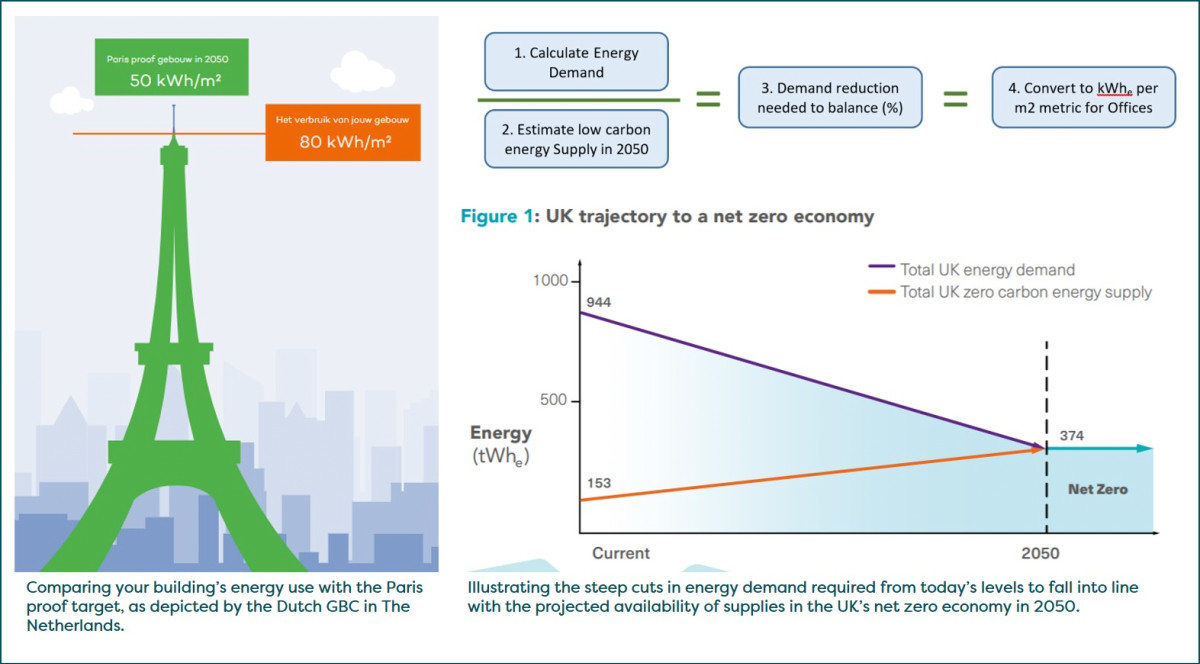

The approach is built on the assumption that building energy use will be constrained by the availability of national supplies of zero carbon (ZC) energy, essentially energy sources not creating CO2 emissions released to the atmosphere arising from the combustion of fossil fuel, such as renewables and nuclear (CCS may emerge in due course). For commercial offices, this led to the incorporation into the Framework of energy efficiency thresholds which assets or portfolios must comply with as one of the steps to a verified net zero designation. The methodology used to quantify these thresholds was the ‘Paris Proof Concept’, originated in 2018 for The Netherlands by the Dutch GBC, and applied to the UK. This determines the necessary ambition to achieve the goals of the Paris Climate Agreement, as illustrated in the diagrams below.

In practice the Paris Proof concept is easier said than done. It is in effect a simple version of the Committee on Climate Change’s (CCC) sophisticated sector by sector net zero pathway model. UKGBC set this out in their Consultation on net zero energy performance targets for offices in October 2019.

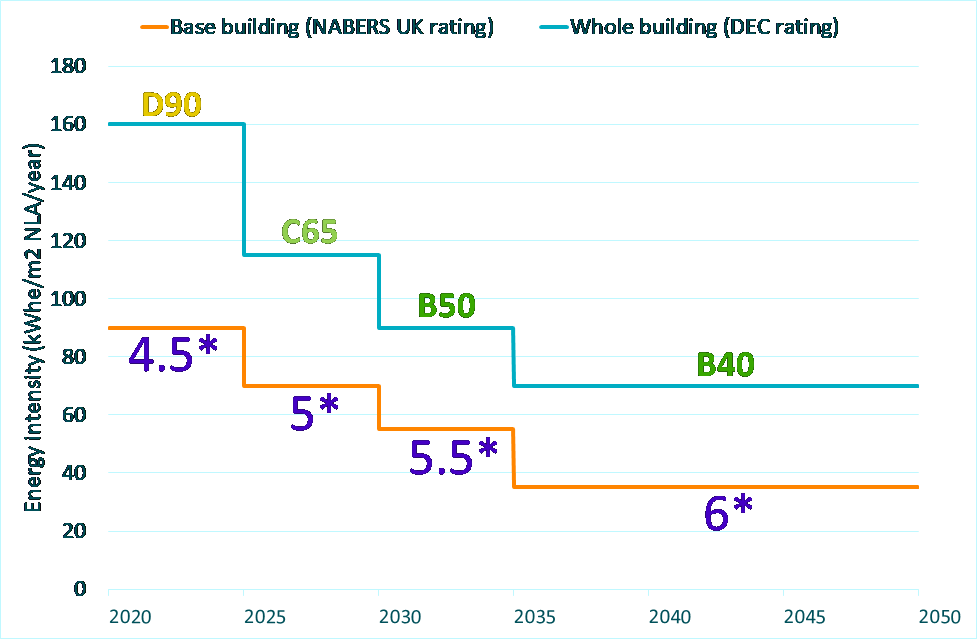

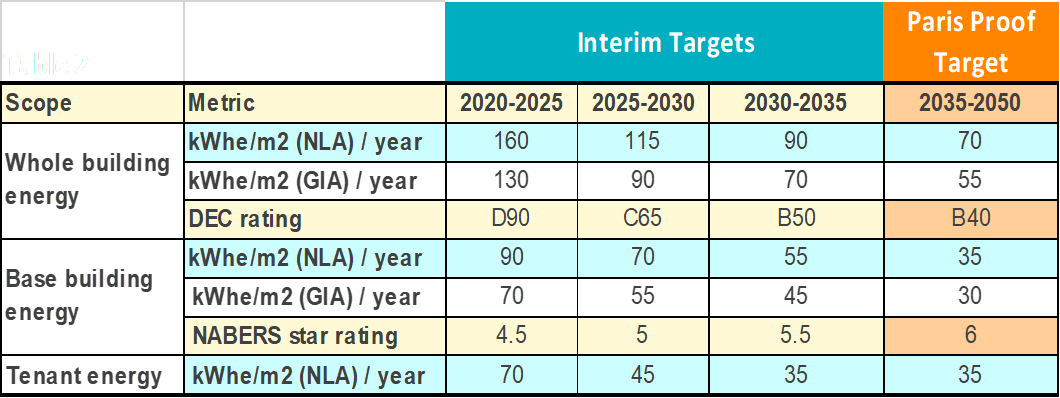

As well as the ultimate net zero targets for 2050, UKGBC published the trajectory shown below for offices targeting net zero carbon and said it does not differentiate between new and existing offices, but it is expected that new offices should aim to achieve the Paris Proof targets as soon as possible. The upgrading of existing offices should also consider the embodied carbon impacts from retrofit and any concessions for heritage buildings.

UKGBC has noted that the targets expressed as DEC and NABERS UK ratings allow for extended hours of use and for special uses, offering a more tailored approach to individual offices, whilst the energy use intensity targets are indicative as they are based on standard hours of use and operation, with kWhe values rounded. For completeness, we show all the targets in the table below.

UKGBC stated these targets are intended to highlight to stakeholders from across the office sector the magnitude of energy reductions required to achieve net zero by 2050, and acknowledged they will challenge the construction and property sector to reimagine the way offices are designed, constructed and operated, including moving towards in-use performance as the verifiable metric for energy.

Verco reflections on the stringency of the targets

Our first response is it behoves us to consider the targets period by period and not jump to comparing current practice with the 2050 goal.

The initial target for 2020-25 is DEC D90. This is effectively the upper quartile or Good Practice (GP) level of the REEB dataset (for 2018-19 data GP equates to DEC D94). To us, this does not seem an unreasonable energy efficiency threshold for an existing building to attain if it is to be designated net zero today. Some people have suggested the REEB dataset may be a biased sample, an optimistic perspective of the UK stock. From our experience, we consider this unlikely, and note it incorporates prime buildings with some of the more highly serviced office specs in London.

This raises another important point: are these targets aimed at leaders or laggards? That is not a technical question. In our experience, there is a tendency in the building energy performance field for the good to get better and the bad to get worse. We suspect this is driven by the former having the right stakeholders and the latter not. If the immediate target were set at say the REEB median, to encourage the laggards, it would not necessarily have the effect some might hope for. Many in the better half of the distribution might not see the need to improve, whilst the worse half might continue to ignore their energy performance.

Furthermore, setting a dataset median as the level of a net zero ambition immediately defines over half the existing stock to be net zero ready today, in the sense no action is needed to be verified net zero other than to write a cheque to an offset company. Would this really be something to celebrate? To define a majority of today’s offices as already sufficiently energy efficient would not seem a proportionate response to a climate emergency.

Moving on to the 2025-30 target of DEC C65, this requires a 30% improvement in 5 years on the current REEB GP. Given REEB GP has improved by 24% in the last 3 years, that does not seem such a big ask. Looking at the base building rating, it is asking for 5 stars which also seems reasonable, given it is the level being achieved today by nearly half of all offices in Australia.

If at this point you are thinking “show us your evidence”, we cite the UK government’s own in-house energy efficiency case studies which are both instructive and inspirational. For example, 3 Whitehall Place (3WP) is a very intensively used fully a/c building with heritage limitations. It started its energy transformation journey in 2008 at DEC G165; 4 years later it was a DEC C75, having achieved a 55% cut in energy intensity by trying quite hard on HVAC plant and lighting, controls and behaviour change. UKGBC’s 2025-30 target of DEC C65 would need 3WP to make only a further 13% reduction. This feels readily achievable with the improved technology available for HVAC plant and LED lighting that has occurred in the last 8 years and indeed can be expected in the next 5 years. 3WP is a powerful case study which demonstrates the 2025-30 target is achievable with modest investment and reasonable payback, albeit with a single tenant committed to the cause.

The 2030-35 challenge is possibly where the pips may begin squeaking, with base building rating expected to be 5.5 stars, but it is only a further 22% reduction after 10 years of climate emergency-driven technology and operational process development from today, the reduction expected incidentally to be spread evenly across base building and tenants.

For 2035 onwards, another 22% reduction is called for, although it is anticipated all the burden could be taken by getting the base building to 6 stars: tenant energy stays the same as for 2030-35. Frankly, who knows what will be happening in offices in 15 years.

If you are wondering how your buildings have a chance of reaching the ultimate goal today, please bear in mind they have 15 years to get there. Indeed, the UKGBC ambition is for all existing buildings to be net zero by 2050. So there are 30 years to get there. The glide path proposed by the targets is there to discriminate between those buildings on the compliant trajectory and those not. It seems to be framed to identify the leaders, perhaps targeting the top 30-50%, although where the targets are intended to sit on the inclusive/exclusive spectrum is open to interpretation. We believe that there is potential to make huge savings in much of the existing stock, hence long term targets should not be aligned with statistically decent performance today - that would be a big step backwards. REEB itself is an example of statistical benchmarking: just because a building is in the top quartile does not mean it is energy efficient. It could just be in the best quarter of a poor bunch. The DEC and NABERS ratings provide absolute benchmarks on linear scales anchored to net zero energy use. They are a more robust test of true energy efficiency.

As soon as performance is made transparent to the market, as the government is planning to mandate following a consultation this summer, Verco believes the massive scope for cost-effective savings will emerge rapidly, especially for the portfolios of the leaders. A key place to start is with a building’s controls, as Verco describes in an article in this month’s CIBSE Journal pp38-40. Next, look at out of hours use (night time and weekends) when most offices are unoccupied. Unnecessary load during these times often goes unnoticed, with even say 5-10 W/m2 mounting up to around 30-60 kWh/m2 over a year, because the unoccupied period can account for about 6,000 hours! Only once the low cost control measures are defined and implemented, should longer term more expensive interventions be considered, such as HVAC system replacement at end of life, solar control and on-site renewables for low rise buildings with significant roof space per m2 of NLA.

Nevertheless, we acknowledge that UKGBC’s proposals test the sector's ability to meet the trajectories and this is because there is a shortage of skills across the board: auditing, implementation of measures and ongoing O&M. But that does not make the targets impossible. The challenge is to make improvement business critical, which has been proven to work in Australia where it has driven a profound upskilling of the supply chain for building upgrades. This has not happened in the UK because operational performance has never been visible and therefore has historically been ignored by the market. Verco’s experience from instigating the Design for Performance initiative gives us confidence that the UK supply chain has the necessary knowledge and appetite to rise to the challenge of following in the steps of our Australian cousins as soon as building performance is prioritised by the market – 3WP proves the point. If anything, performance disclosure is the silver bullet; a magic technical solution is not needed.

That said, our observation of the transformation of the commercial offices market in Australia identifies some key differences, specifically the organisational arrangements for responsibility and control, accompanied by delineation of energy use between landlord and tenants according to who has agency to manage and improve, and rating and disclosing each separately. The norm in Australian offices is for landlords to have responsibility and control of the whole building HVAC services, including those that are inside tenants’ demises. Tenant leases require the landlord to provide an internal environment suitable for office work for the hours of use contracted by each tenant. The landlord is judged on the energy efficiency of their provision, as measured by the NABERS base building energy rating, and this has driven the remarkable improvement in energy efficiency across the whole Australian office stock.

We accept, even with Australia to learn from, it might take 5 or even 10 years to get base building ratings averaging 5 stars for the whole stock, but that is accommodated by the UKGBC targets. Bearing down on tenant loads may seem harder to landlords, but here help is at hand from the easy technical solutions of smarter and very low energy LED lighting and outsourcing servers to the cloud, both of which are eminently doable over this time frame.

As a final point, we have to reflect on the supply side assumptions behind the targets. We would note that when the targets were being prepared, industry renewables advocates were calling for more than 100GW of new wind and solar generation to hit net-zero carbon emissions by 2050: https://renews.biz/55820/uk-net-zero-needs-100gw-extra-green-power/ This seemed to indicate renewables output about 20-30% higher than the UKGBC extrapolation of BEIS projection out to 2035, so not a major misalignment. The development of renewable capacity has been notoriously conservative in the past. Even the highly respected late Chief Scientist at DECC seemed to underestimate the potential in his seminal analysis “Sustainability without the hot air”. But times have changed and it is not exactly clear why the CCC net zero pathway anticipates 645 TWh of cost effective non-fossil sources by 2050 whilst BEIS projections infer 374 TWh. As a somewhat flippant aside on futurology, one cannot avoid noticing that the Budget has just increased funding for nuclear fusion, 65 years after the chairman of the U.S. Atomic Energy Commission claimed nuclear fission would become too cheap to meter.

If the ZC supply in 2050 is doubled from BEIS projections, the stringency of the commercial offices target might be relaxed. But better performing buildings will have to compensate for worse (or heritage) if the non-domestic stock is to pull its weight. And perhaps non-domestic buildings will need to do more than the average economic sector given the technical and economic challenges associated with decarbonising sectors such as aviation and heavy industry. A high performance building is furthermore likely to be rewarded through an increase in its asset value, lower voids and a higher yield. What’s not to like?

This is a complex topic with significant long term uncertainties on both the supply and demand sides of the equation. Verco believes the UKGBC approach cuts through a lot of the noise and has come up with a concisely articulated strategy through its framework and energy efficiency targets. It may not be the last word, but it is certainly a solid foundation from which to move forwards on a no regrets basis.