IPF publishes research, conducted by BIP.Verco, into Pathways to Net Zero in International Real Estate Investment

Many regions of the world are already experiencing damaging effects from extreme weather events and rising sea levels and these impacts are only predicted to worsen. The continuation of increasing emissions will eventually cause severe disruption to business models and investment markets, as local effects are transmitted through the highly connected and interdependent global economy. In the wake of CoP26, this reality is fresh on everyone’s minds - achieving net zero is no longer just the morally right thing to do, it is a socio-economic imperative.

With the built environment being responsible for over a third of global energy related carbon emissions the building industry stands to play a crucial role in the global transition to NZC. Yet, this represents a monumental challenge, requiring exceptional levels of collaboration between stakeholders from a diverse range of professions, and alignment around a set of clear and consistent principles.

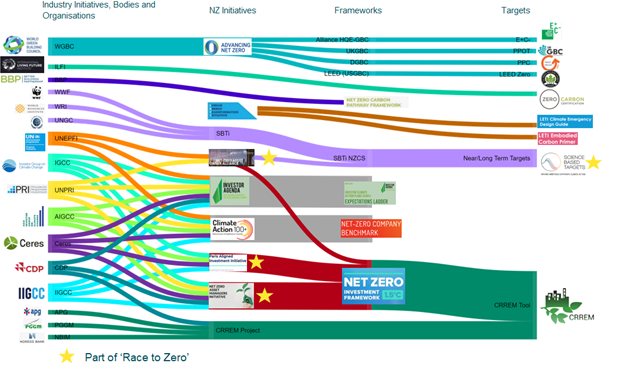

In anticipation of a severely carbon-constrained future, global investors are looking at their portfolios to identify and address the underlying climate risks. In the real estate investment sector, many schemes are emerging to support the industry through this transition, each providing different interpretations of what net zero means and how to achieve it. The variety of differing approaches and the interconnectivity of market schemes has resulted in a confusing landscape for asset owners, managers and investors to decipher – illustrated in the figure below. However, variety is needed in the market to address the unique requirements of different asset types, locations and organisational structures. A major underlying issue is in the inconsistency of net zero definitions and the lack of clarity on differences between the available schemes within the market.

The IPF Research Programme recently commissioned BIP.Verco to investigate this landscape and consider the challenges that the real estate industry faces in defining and delivering NZC. Basing its research on literature reviews, stakeholder engagements and case study analysis, BIP.Verco have examined the variation in scope, stringency and applicability of a set of major net zero schemes, relevant to the real estate industry. This project identified five key messages relating to the transition of real estate investment to NZC:

- Demand for NZC property is increasing, as a growing number of governments, investors and occupiers make public commitments to NZC.

- Misaligned definitions of NZC (and how to reach it) creates a source of confusion in the market. This is due to the myriad of market driven and regulatory schemes being used for public commitments.

- Convergence on a common definition of NZC from asset owners, managers and occupiers is required to provide a robust framing of net zero. This will support the alignment between net zero schemes and the appropriate allocation of capital for carbon reduction.

- Several challenges exist for the industry to overcome, including a skills gap around net zero concepts and practices, limited evidence of the costs of net zero retrofit and a lack of primary data to quantify the carbon impact of some aspects of real estate investment.

- Further challenges are posed by the potential unintended consequences of the NZC transition, including high embodied carbon impacts from retrofits and redevelopment, and the social and economic impacts of asset ‘stranding’ due to perceived climate risk.

Common Vocabulary

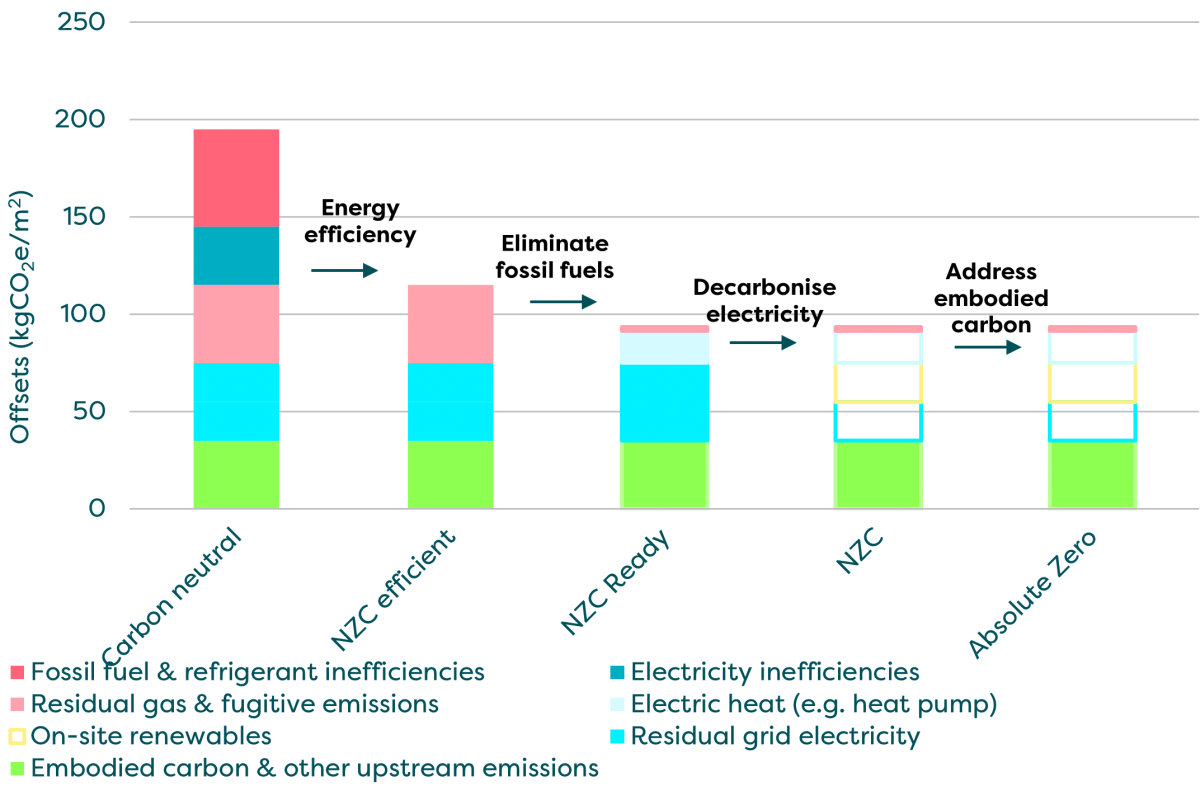

The second finding, in the above list, highlights the lack of alignment between net zero schemes on definitions of NZC, in the context of real estate. Consequently, the net zero commitments of two separate entities (i.e. buildings, funds or organisations) can have very different meanings. This lack of alignment particularly applies to building-level commitments. To bring greater clarity to the market, the report has presented a set of definitions to determine the different stages of a building’s transition to zero carbon.

These definitions are summarized below, alongside a figure which graphically illustrates the differences between each definition. The coloured segments in this graphic refer to different sources of emissions, while the transparent segments indicate that the building’s energy intensity is unchanged but the associated carbon emissions have been eliminated by the supply side of the building’s value chain. Under each definition the residual emissions are to be offset to achieve each status.

Carbon neutral

Where a building’s GHG emissions have been measured and countered with an equivalent quantity of GHG reductions or removals, which may be in the form of offsets. In this situation there is no obligation to deliver any emissions reduction or abatement.

NZC efficient

Where a building has undergone steps to improve energy performance and remove any inefficiencies relating to energy use. Removing energy inefficiencies from a building (and thereby reducing the energy demand) will lessen the requirement for electricity and ensure that, by 2050, each economy is consuming a level of electricity that is achievable within national limitations of zero carbon generation.

NZC ready

Where a building has identified and eliminated any inefficiencies and has also replaced any fossil-fuel driven heating, hot water or catering services with low carbon equivalents. The building is ‘ready’ for the final step to NZC – the total decarbonisation of the electricity grid.

NZC

A building that is NZC ready and based in a location with a fully decarbonised electricity grid. The burden of this definition therefore lies with policy makers and operators of national electricity grids. Some approaches to defining NZC advocate the use of the term ‘net zero’ at the ‘NZC efficient’ stage providing that the building has an action plan or trajectory in place to get there.

Absolute zero

This refers to the point at which all emissions have been eliminated from the building, with no offsetting. This includes the total elimination of embodied carbon emissions – those associated with the manufacture of construction materials and the construction process.

Case studies

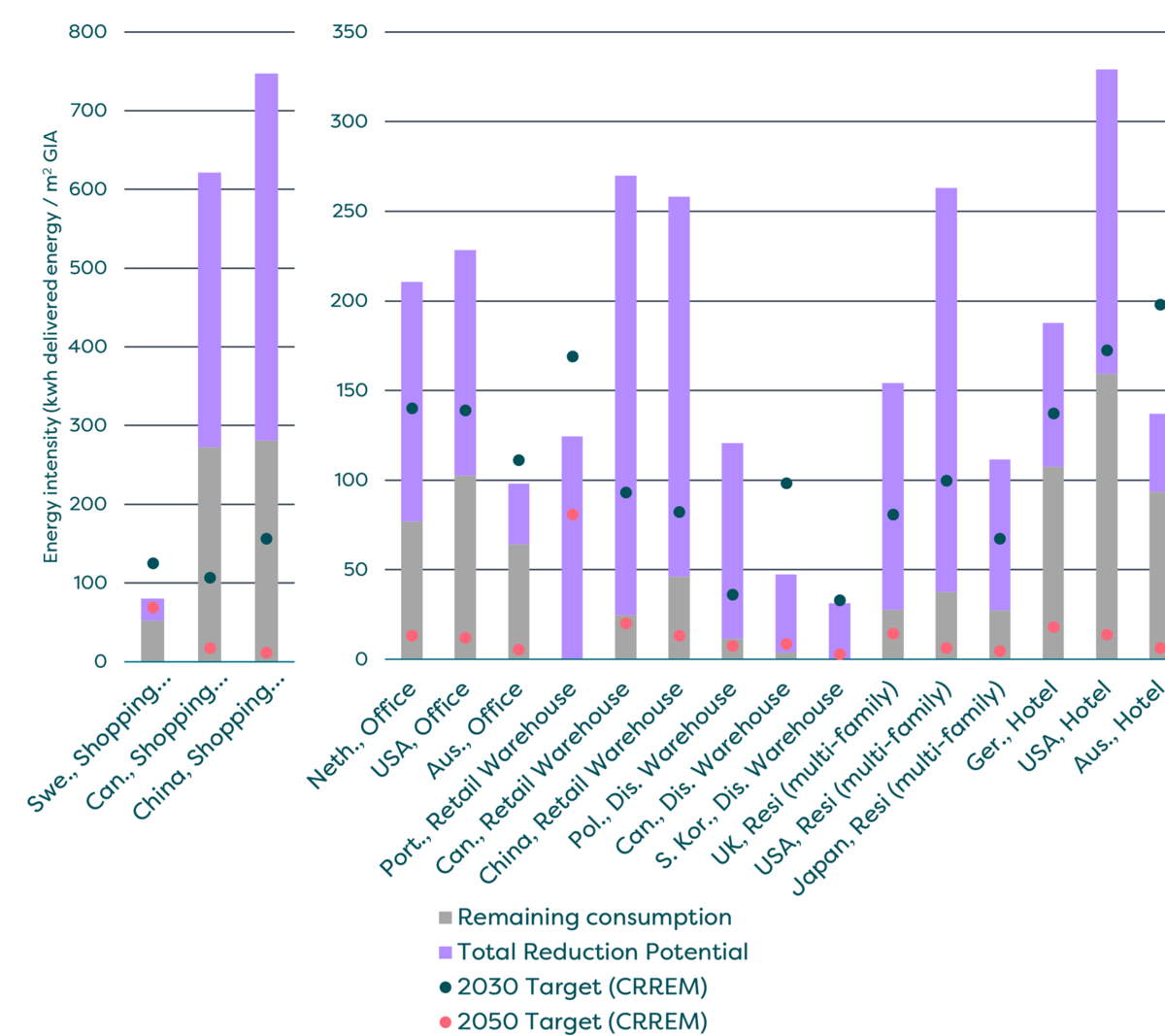

The report further highlights the misalignment of net zero schemes through a set of case studies. These compare the requirements for emissions reductions of a range of schemes, as they apply to 18 different building archetypes (differentiated by location and asset type). As part of this exercise, BIP.Verco applied their A4Z model for carbon reduction measures; developed through BIP.Verco’s involvement in a multi-million pound government research project and the company’s broad industry experience. This analysis highlighted the challenge that the industry will face in using current technologies to reach the targets set by net zero schemes for 2030 and 2050.

Recommendations

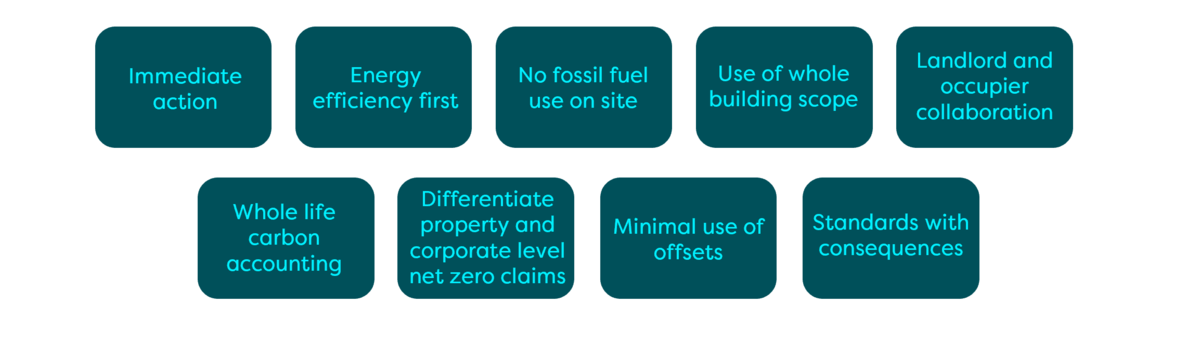

Based on the findings of this research, convergence around a set of core principles among asset owners, managers, and occupiers, is the key requirement for the industry’s transition to NZC. The report proposes a set of such principles, which can be used to underpin NZC in real estate:

A set of recommendations have also been proposed for the market to integrate these principles into best practice:

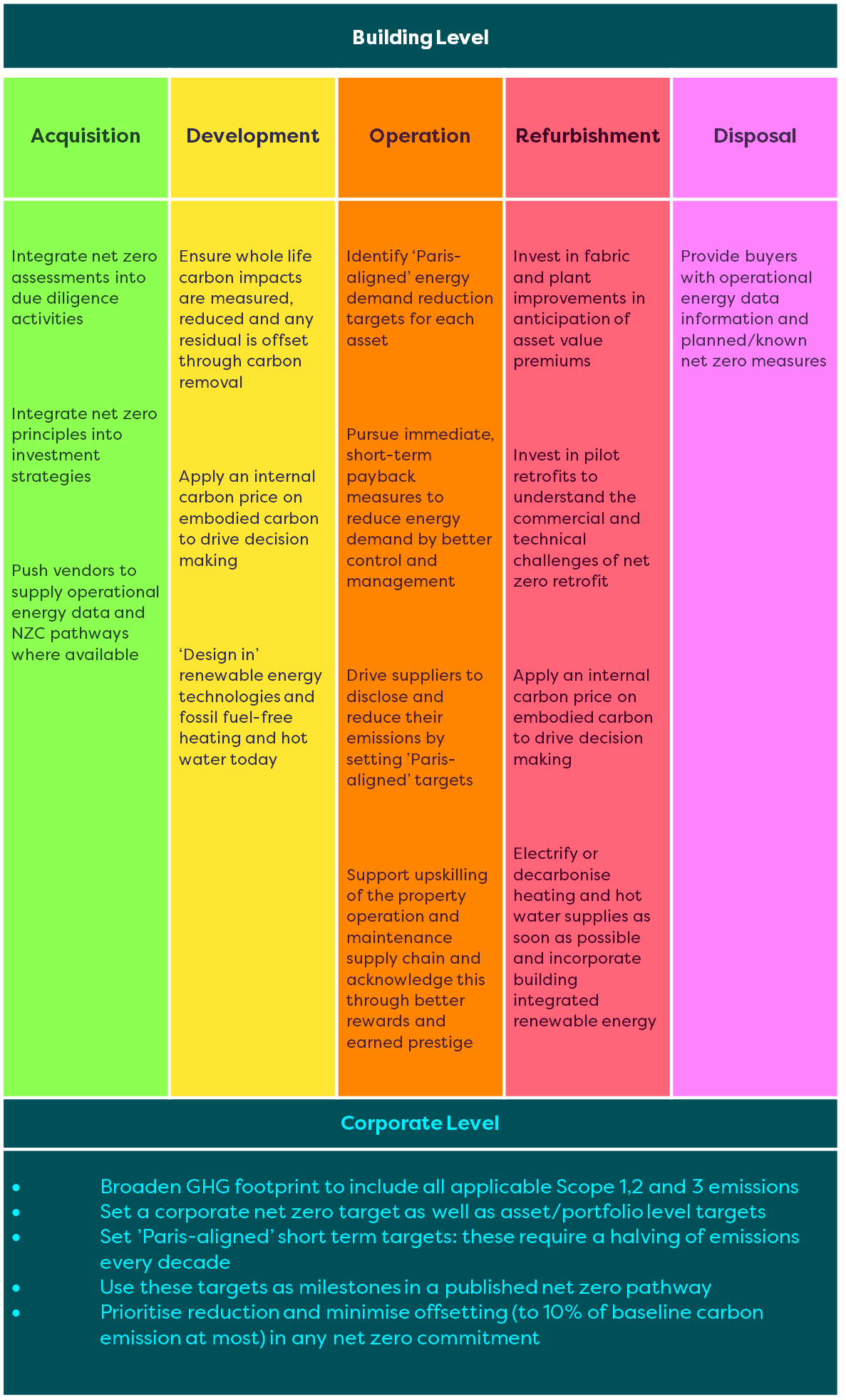

While the above driving forces are required at an industry level to transition to NZC, it is imperative that real estate investors and asset managers act without delay to apply the findings of this research to their investment and management strategies. The following key actions have therefore been identified for these stakeholders at both building (categorised by each of the five main stages of an asset lifecycle) and corporate levels:

The built environment is one of the largest contributors to global carbon emissions. However, there is a significant lack of alignment within the real estate industry currently as to the definition of NZC and how the market can effectively transition to net zero. There is little regulatory leadership and minimal evidence of carbon consideration within the valuation process.

Adopting a consistent set of net zero principles and a standardised vocabulary – as provided by this research – will bring greater clarity to net zero in real estate; enabling the certification of building performance against a consistent set of NZC metrics and allowing for the pricing-in of carbon within building valuations. While market participants will need to drive action at the industry level to facilitate this, the recommendations from this research can be used to set and implement effective net zero strategies, immediately.

The report is available on the IPF website.

Members of the BIP.Verco research team have shared some of the details behind the report in our webinar: IPF research - Pathways to net zero in real estate- insights from the BIP.Verco research team.