Pain-free pre-assurance: How to calm assurance nerves without breaking the bank

The environmental reporting landscape is constantly changing, with the spotlight on assured data shining ever brighter.

Despite this, many businesses face reluctance across the board when it comes to assuring data. The assurance cycle can be costly, time-consuming and complicated. Often, there’s a lack of confidence that the data will pass an assurance cycle, and many within a team are unaware of what is required throughout the assurance process.

However, the benefits of assured data speak for themselves. Assurance provides the report preparer with confidence that what they are disclosing is accurate. It also reassures stakeholders that the disclosed data is well-controlled and of good quality.

If you see why assurance is beneficial, but you feel far away from being assessment-ready, pre-assurance support might be a good next step. It can guide you through the process, enlighten your team and calm your nerves, all without breaking the bank.

What is pre-assurance and how does it help?

Pre-assurance is a broad assessment that mirrors aspects of the assurance process. However, unlike a formal assurance process, it is followed up with advice and guidance to help you improve. It includes a detailed review of reporting practices, governance structures and supporting documentation to help a business identify whether the expectations of assurance providers will be met. Pre-assurance is often used to test how close an organisation is to being ready for assurance. It goes further than a gap analysis by evaluating whether existing measures would hold up during external review. It also suggests ways to improve the quality, coverage or robustness of data.

In general, pre-assurance is an opportunity to better understand the requirements of the assurance process, especially under specific standards such as ISAE 3000 or the forthcoming ISSA 5000. Additionally, it can be a great way to upskill internal teams’ understanding of assurance requirements, learn how to identify gaps in data and generate outputs that lead to better quality decisions.

Pre-assurance is a cost-effective option, compared to a full assurance engagement, and it allows clients to prepare in advance for a smoother and more positive assurance outcome.

How Verco can help with your assurance challenges

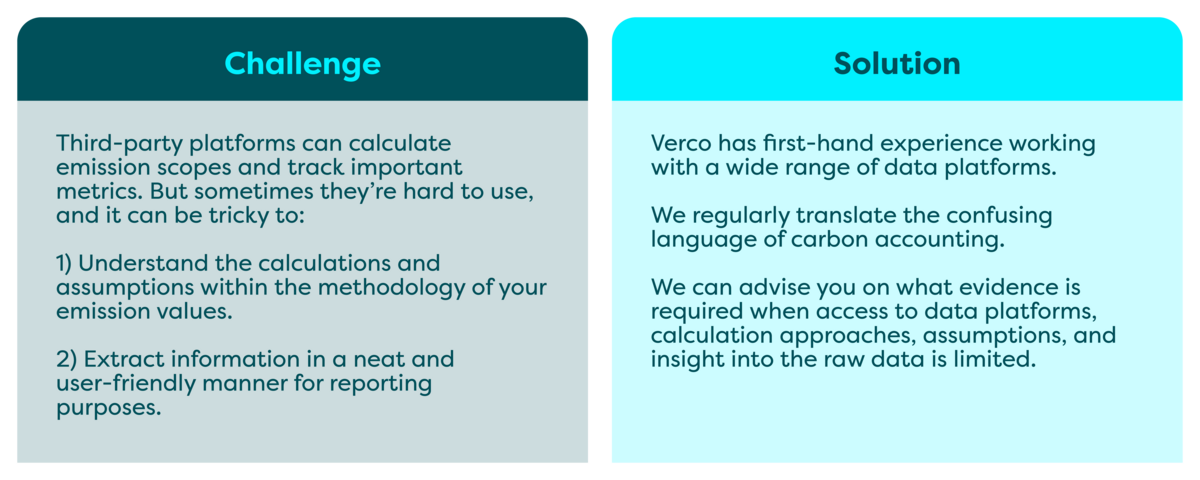

Limited data platform accessibility

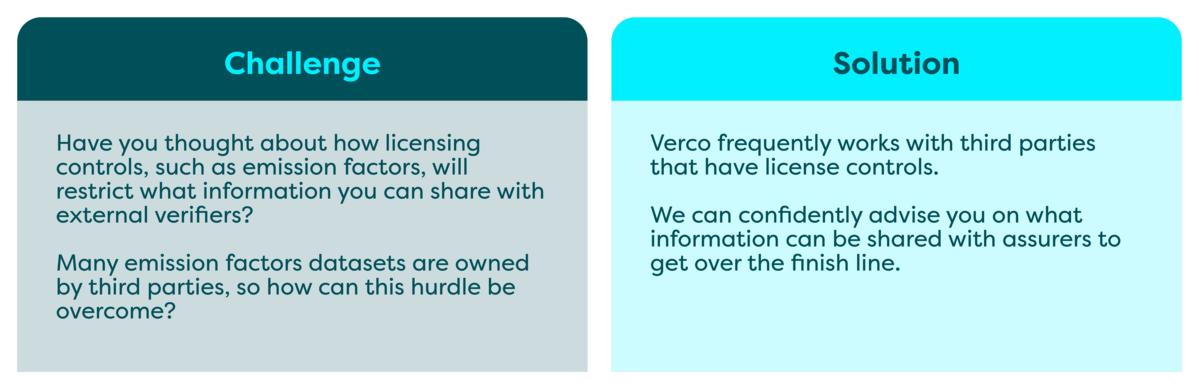

Licensing restrictions

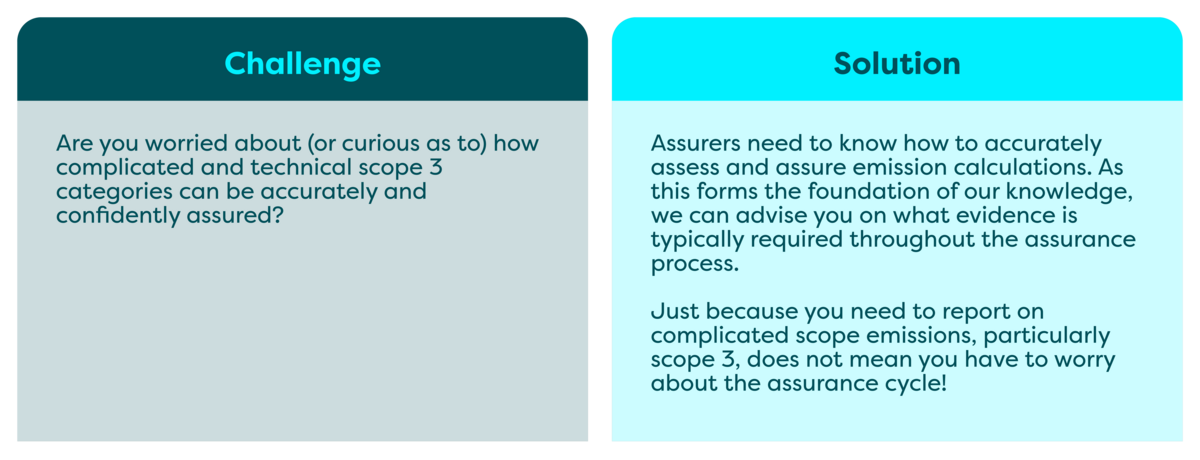

Complicated and sector-specific scope 3 calculations

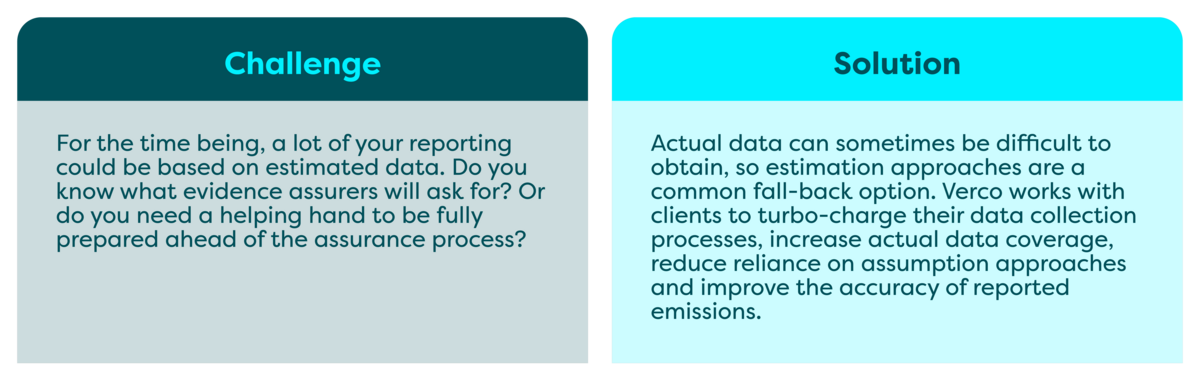

Estimated data

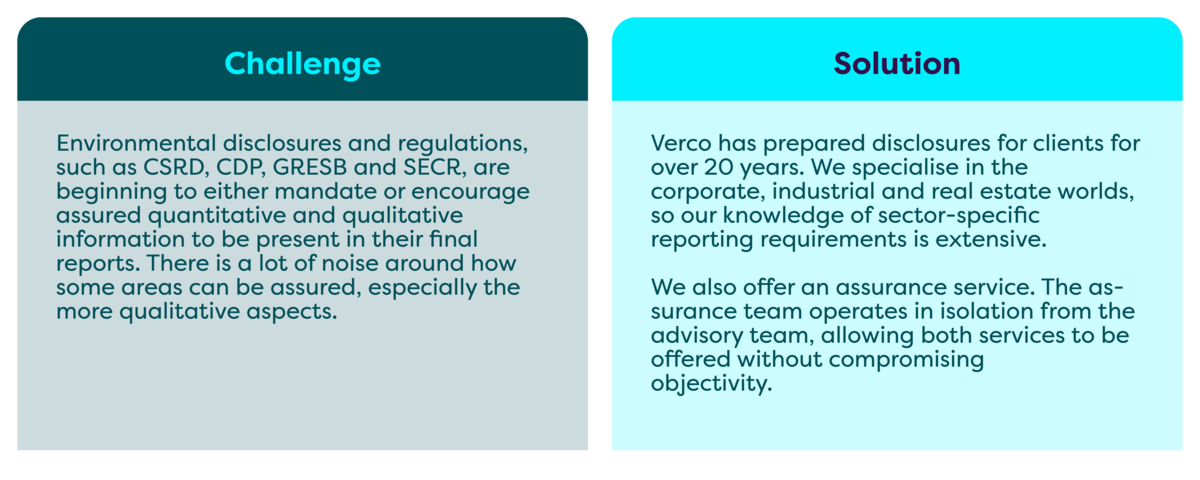

Mandatory reporting disclosures

Find out more about our pre-assurance service

Find out more about our assurance services

What else can Verco offer?

Annual Reporting

Verco helps clients prepare their annual reports, whilst providing insightful data analysis on monthly, quarterly and yearly trends to guide internal decision making. Find out more here.

Occupier Data Collection

Without prior and appropriate green clauses/leases or tenant permissions in place, collecting occupier data can be a difficult hurdle for any company to overcome. Verco can help fill this gap. Following successful data collection and data quality improvement advice, we are more than happy to discuss how we can help with your tenant engagement to target Scope 3 (leased asset) emissions reductions. Find out more here.

CSRD

Are you aware that you need to report to CSRD in the coming years? Do you need guidance on where to begin and where your focus areas should lie?

The goalposts of CSRD are constantly moving, with future amendments still expected. Verco’s team of experts are ready to help you navigate the challenging world of CSRD disclosure and can keep you updated on all major and minor changes. Contact us to find out more.

Join our webinar discussing assurance and pre-assurance

If you have questions about the differences between assurance and pre-assurance, we invite you to join our upcoming webinar, ESG Assurance – what you need to know, on Tuesday 14th October. During the session, Verco’s assurance experts Jing Wang and Mark Challis will discuss a variety of frequently asked questions, including what assurance really is, which types of standards to assure against and how to assure different types of data.

Click here to find out more and register for the webinar

Experts on the topic