Protecting value and credibility: the strategic role of SLL assurance for private equity

SLL assurance is an important yet underutilised tool that can help general partners and private equity firms optimise and prove progress towards climate commitments. In this article, BIP.Verco’s Head of Assurance, Jing Wang, and Associate Director of Private Markets, Myles Tatlock, discuss the hurdles this sector faces, how assurance can help, and the questions to ask yourself to make sure you’re on track.

Sustainability-linked loans (SLL) have reached 650 billion Euros in 2024, accounting for 72% of the sustainable loan market.1 According to a 2025 article in Private Equity International (PEI), over half of the largest private debt funds are using them.2 For General Partners (GPs), this creates a pressing dilemma: ambitious SLLs are a competitive advantage, but the operational complexity of proving performance across a dynamic portfolio introduces financial and reputational risk.

When private equity (PE) firms are increasingly leveraging SLLs as part of their value-creation playbook, the message from regulators is the market has matured, yet barriers remain.3 Common weaknesses are poorly designed key performance indicators (KPIs) and sustainability performance targets (SPTs). Many GPs are wrestling with how to operationalise science-based climate commitments. While the principles like the SBTI’s Financial Institutions (FINZ) Standard are clear, driving consistent emissions reduction across diverse portfolios is far harder and more resource intensive.

In this context, SLL assurance is emerging as one of the most powerful, yet still under-utilised tools for PE managers. In broader capital markets, it is often seen as a reporting requirement, but for PE its value goes deeper. Assurance converts ESG performance from a narrative exercise into a portfolio management tool.

Many PE managers conflate assurance with Second Party Opinions (SPOs). The difference is fundamental. SPOs focus on pre-issuance and evaluate the design of the SLL framework. Assurance is primarily for post-issuance, assessing the actual sustainable performance against KPIs. For SLLs tied to interest margin adjustments, assurance provides the crucial evidence that lenders rely on to make pricing decisions.

The GP Benefits of Assurance

1. De-risking financial outcomes

Independent assurance reduces disputes with lenders and ensures accurate, defensible application of performance-based margin adjustment.

2. Early identification of portfolio-wide issues

By examining ESG data and controls across multiple portfolios, assurance highlights common weaknesses, allowing GPs to intervene before annual KPI testing.

3. A credibility buffer in times of uncertainty

When portfolio companies (portcos) struggle with SBT adoption or ESG data system changes, assurance demonstrates to stakeholders that ESG targets are being pursued with rigour.

4. Institution-grade reporting for LPs

Assured data strengthens annual sustainability reporting, fundraising materials and responses to LP due-diligence questionnaires.

PE faces unique hurdles and structural complexity

PE firms face complexities that single-corporate SLL issuers do not, such as:

1. Data aggregation across diverse portcos

Portcos operate with different ESG maturity levels, systems, geographic footprints, and data quality. Standardising information to test fund-level KPIs is often the biggest barrier to credible reporting.

2. Changing portfolio composition

Acquisitions and exits make setting baselines for PE firms difficult. Firms must determine how to allocate KPI contributions across companies over time, and performance is hard to verify without clear rules.

3. Misalignment between fund-level KPIs and portco realities

Fund-level SLL KPIs often rely on aggregated metrics, such as portfolio emissions intensity. Yet portcos differ greatly in terms of sector, scale, and data sophistication.

4. The SBTi alignment challenge

Many SLL KPIs depend on progress against science-based targets. When portcos delay or reconsider their own SBTi pathways, PE firms must still provide evidence of credible progress.

Where do you stand?

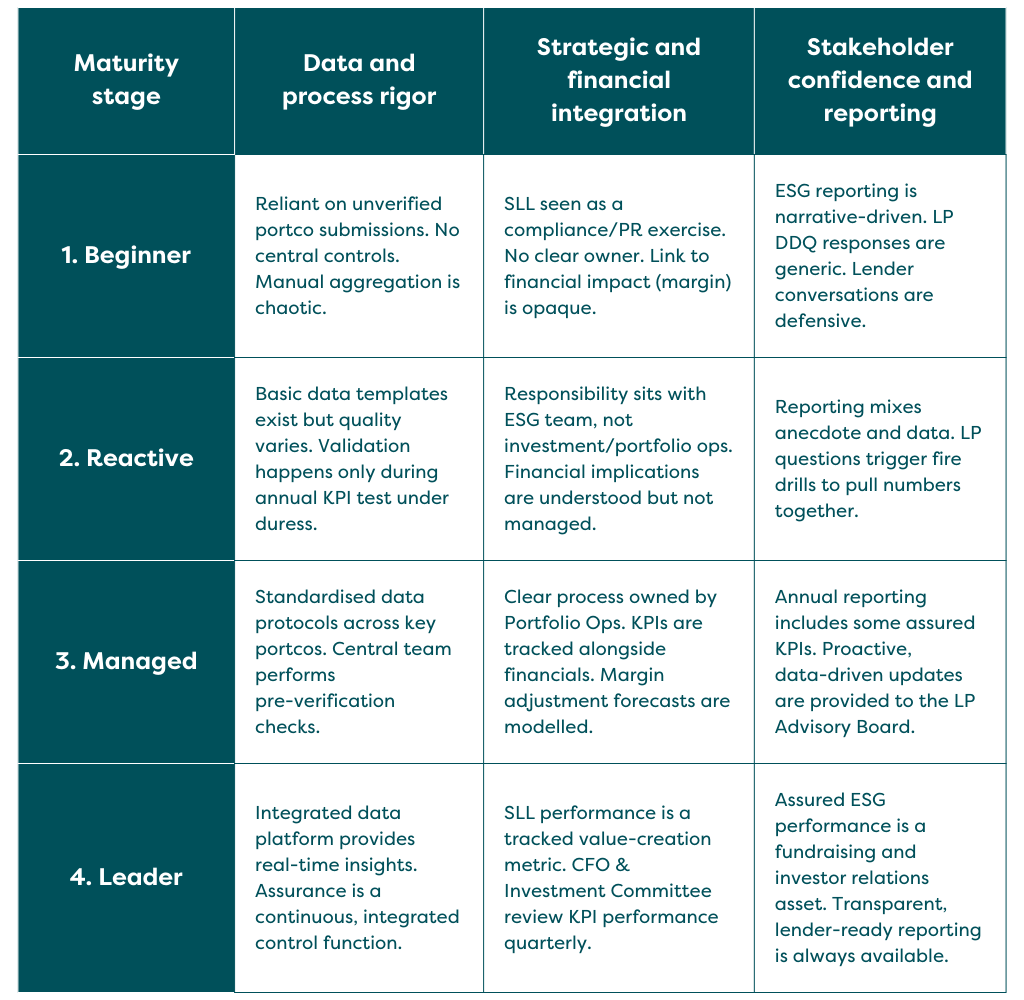

The maturity of your SLL assurance process directly impacts your financial risk and your ability to leverage ESG performance for value creation.

Use the matrix below to assess your firm’s position across four key dimensions. Most firms find they are at different stages across different dimensions.

This self-assessment highlights not just current gaps, but the tangible risks and missed opportunities at each stage. Growing in maturity requires a tailored approach that addresses both operational rigor and strategic integration, which is precisely where a specialist assurance partner adds critical value.

BIP.Verco’s approach for PE-focused SLL assurance

BIP.Verco’s SLL assurance process is designed for the portfolio context. We focus on supporting, not burdening, fast-moving investment teams by turning verification into actionable insights.

Our PE-tailored methodology includes:

1. Scoping and KPI mapping

We work with the GP to understand the structure of the SLL, the KPI methodology, and the data flows across the portfolio. This establishes which portcos contribute to each KPI, identifies data sources, and pinpoints high risks, ensuring minimal disruption and efficient testing.

2. Data validation and testing

Our experienced practitioners conduct targeted testing of controls, calculations, and reported outcomes, using technology to speed up sampling and validation. Testing is risk-based and meets standards such as AA1000 and ISSA 5000.

3. Issue analysis findings

We consolidate portfolio-wide findings and identify misstatements and gaps. The insights support data quality enhancement, operational improvement, and future SLL structuring.

4. Clear and credible reporting

Our output typically includes an assurance statement for lenders and an internal findings report for the GP. These highlight risks and observations for continual improvement, LP reporting, and value creation plans.

While assurance carries a cost, the payoff can be significant. For leading PE firms, assurance is becoming a core component of portfolio value-creation and risk management. By building a credibility mechanism through assurance, you can transform SLLs from compliance obligations into vehicles for disciplined, data-driven performance.

Sustainability-linked loans are a valuable financial tool for PE firms, when backed by credible, verifiable ESG performance. As complexity increases around SBT alignment, portfolio variability, and data aggregation, assurance offers clarity and strategic foresight. For GPs who want to safeguard financial outcomes, meet stakeholder expectations and drive ESG-led value creation, SLL assurance is not just a requirement. It is an essential advantage for those who intend to lead in the next era of value creation, where credibility is the currency.

5 questions for SLL assurance readiness

Do we have a single, documented, and controlled methodology for aggregating KPI data from all material portfolio companies?

Inconsistent calculations are the leading cause of material misstatement and lender disputes.Have we formally defined and documented how acquisitions and divestments are treated within our SLL KPIs for the performance period?

Without clear rules, year-on-year comparisons are meaningless, and performance cannot be fairly verified.For each KPI, can we provide auditable source documentation (e.g., utility bills, survey results, policy documents) from our portcos that directly supports the reported number?

Assurance is an evidence-based exercise. Narrative explanations are not sufficient.Is there a clear owner within the GP (e.g., Portfolio Ops, CFO function) with the mandate to challenge portco data submissions before they are consolidated?

Effective internal controls are the foundation of credible reporting and reduce costly last-minute corrections.Have we modelled the potential financial impact (margin adjustment) of our likely KPI performance, and is this reviewed by the finance team?

This transforms the SLL from an ESG topic into a financial instrument, ensuring appropriate oversight and risk management.

If you have unanswered questions here, your SLL could be exposed. This checklist protects your financial position and fulfils your strategic commitments to lenders and LPs.

Learn more about the assurance process

Find out about our assurance services