The Science Based Targets Initiative's net zero draft guidance- implications for real estate

The Science-based Targets Initiative (SBTI) is developing the first science-based global standard for corporate net-zero targets, due at the end of 2021. Last week (Jan 28th) the SBTI published a draft of the Net Zero Standard Criteria. The authors are now seeking feedback. In this guide we describe the key points and the implications for real estate companies interested in the SBTI’s Net Zero designation.

The SBTI’s Net Zero criteria are designed to assess net zero commitments, not performance today.

This is an important point to note – the SBTI are proposing a standard for judging whether or not corporate carbon targets that claim to eventually bring no net carbon impact ‘are consistent and robust’. Businesses which meet this eventual standard can claim to be ‘in transition to net-zero’, not ‘net zero’ today.

The net zero commitment year must be 2050 or sooner.

As a rule this is unlikely to catch many real estate companies out – the message of ‘net zero by 2050’ from climate science and the United Nations has been heard loud and clear. Indeed many businesses are choosing 2040 or even 2030 commitment years (Great Portland Estates, The Crown Estate and Grosvenor Britain & Ireland among others).

If a net zero commitment year is far into the future, an interim science-based target will be required.

In other words, if your commitment is ‘net zero by 2031 from a 2020 baseline’ or later, you may need to set an SBT target for the interim period. The SBTI is debating two options for the length of this period – 10 or 15 years. Those opting for 2040 or 2050 commitment years may find there is a little more work to do to secure the SBTI’s new standard and will have to commit to an achievable interim target. Interim targets are a sensible mechanism to provide shorter-term focus to a long-term goal and may encourage a phased approach to decarbonisation – focussing on the easier areas for the interim targets (Scopes 1 & 2 in particular).

The SBTI is considering increasing the ambition of these interim SBTs, compared with the current SBTI criteria so they are consistent with reducing global emissions by about half by 2030(1).

For example, the SBTI is looking at making the 1.5-degree pathway (1.5D) the minimum ambition level for Scopes 1 and 2 from 2022, doing away with the ‘well below 2 degrees’ (WB2D) pathway. There is a big difference – if for example we take a 2020 base year and 2030 target year the 1.5D pathway requires a 42% reduction in absolute carbon emissions compared with 25% in the WB2D pathway. If the criteria change, those businesses with WB2D (or 2D) SBTs established under the old regime may find their commitments no longer stack up to the market. As of February 2021, approximately half of real estate businesses with SBTs in place (20 out of 41) do not meet the 1.5D pathway. New SBT applications should aim for this as a matter of course if they want the best protection against future changes. More importantly, this is consistent with the science.

The SBTI are also considering tightening the Scope 3 requirements, demanding targets that are wider in scope, or tougher in ambition. This will drive a need for better estimation techniques and ultimately measurement of emissions from developments, tenant energy and wider supply chain activities.

The base year must be 2015 or later, or the same as an existing SBT.

As with all targets we recommend a recent base year for greater credibility and robustness to reflect up-to-date trading conditions. 2020 will probably be an unlikely choice for most businesses given COVID-19 disruption. With 2021 affected too, and the outlook for 2022 still foggy, we’re likely to see a lot of businesses use 2019 or even 2018 as a target base year.

The SBTI are undecided as to whether net zero abatement targets can be intensity based as well as absolute.

The answer might be both. In practise absolute targets have proven more popular in recent months - The Berkeley Group, Unibail-Rodamco-Westfield SE, CBRE, Nomura Real Estate and Workspace have all set such targets in the last 3 months. It is worth noting that the SBTI are in parallel developing a sector-specific approach to target-setting for financial institutions, - including asset owners and managers – which follows the floor area normalised Sector Decarbonisation Approach. See below for more details.

A net zero commitment must cover Scopes 1, 2 and 3.

Value chain emissions must be included and need to be abated by an amount consistent with a 1.5D pathway. The SBTI are debating three options around coverage – either the target must include 67% of Scope 3, 95% of Scope 3, or 95% of Scopes 1, 2 and 3. Whatever the final decision, for most real estate companies this will mean including at a minimum tenant energy usage and whole life carbon for each owned asset going forwards(2).

If the second or third options are chosen this could mean looking further – to the lifetime energy use and end-of-life of buildings developed and sold, employee commuting, business travel, waste – perhaps even occupier commuting and visitor travel. It will also mean looking at indirect investment activities, debts and securities, which is an area we are actively exploring with clients. In our experience few real estate companies have fully baselined their carbon impact in these areas. The first step is to estimate – even crudely – the materiality of each area using a benchmark approach before diving into the detail to quantify fully. The ‘lumpier’ emissions sources – those that can jump around from year to year – pose the greatest challenge for target setting. Most notably we have found development activity can drive this lumpiness. The UKGBC’s Scope 3 reporting guide provides some guidance on how to handle these peaks and troughs but firm industry guidance has yet to emerge.

Companies must set a target to neutralise all unabated value chain emissions with permanently removed carbon.

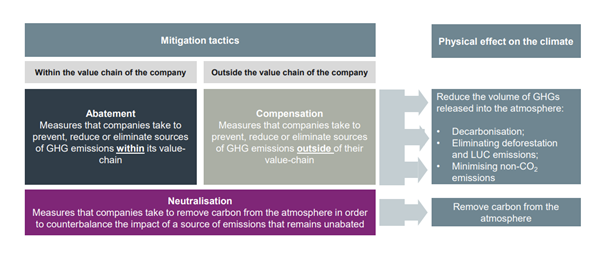

A company will need to balance carbon ‘abatement’ (reduction in emissions) with ‘neutralisation’ (carbon removals) (see Figure 1). The abatement part will need to follow a science-based trajectory. The neutralisation part can happen directly within their value chain or beyond. Those with rural estates might turn to nature based solutions for direct removals within their scope 1 reporting. Most organisations will have to use contractual instruments (i.e. carbon offsets from carbon removal projects). In the long term these should include carbon capture and storage. For the moment however, only offsets from natured based solutions are widely available. Page 57 of the SBTI paper itself points out some of the critiques of these in terms of doubts about the permanence of the carbon storage and the lack of equivalence with emission abatement projects in terms of climate outcome.

Regarding the neutralisation boundary, the SBTI again offers two options – firstly that neutralisation must cover all emissions in the value chain, or just those in the abatement target boundary. If they opt for the former, the pressure to measure and manage all aspects of value chain emissions will be even stronger. For any scope 2 or 3 emissions that are dealt with through removals, there will be a need to demonstrate that they have been uniquely neutralised. It’s worth noting at this point that the SBTI still place the responsibility with businesses to decide what is ‘in’ and ‘out’ of their Scope 3 footprint, but we expect that with more businesses presenting their targets to the SBTI there will be fewer places to hide those hard-to-quantify or abate emission areas.

We note differences here between the SBTI’s Net Zero Standard and that of the UK Green Building Council. Under the UKGBC definition, buildings can be labelled ‘operational net-zero’ now if they meet certain operational Energy Use Intensity (EUI) standards and offset all actual emissions. For new developments ‘construction net zero’ can be claimed by addressing all construction impacts through offsets. The SBTI criteria enable businesses to be labelled ‘in transition to net zero’. Another important distinction is the amount of ‘abatement’ deemed acceptable by the two approaches. The UKGBC’s criterion – which is expressed in the form of EUIs rather than carbon emissions – has been calculated based on predictions of 2050 renewable energy supplies. This aims to ensure that buildings reduce their consumption to a fair share of the total zero-carbon generation capacity and is known as the ‘Paris-proof’ approach, first adopted in the Netherlands. In contrast, the SBTI’s approach allows business with operations in countries like the UK to benefit from rapid grid decarbonisation and track a steady downward course in their Scope 2 emissions. The limited capacity of renewable energy in the future is not considered as a constraint. UK and Dutch real estate companies might consider the UKGBC or Dutch GBC approach in addition to the SBTI.

‘Compensation’ is encouraged to cover GHGs released during the journey to net zero.

The SBTI uses the term ‘compensation’ to refer to a company’s actions or investments to mitigate GHG emissions during the transition to achieving a net-zero target. The SBTI proposals shift the focus away from the ‘emit freely and offset’ ethos associated with some carbon neutral claims. Instead, they advocate setting a price on carbon commensurate with the societal cost of unabated carbon emissions, then using the money in a wider range of actions to help the global transition.

Options include supporting research and development, providing direct investment in climate solutions, as well as purchasing ‘high quality’ carbon credits. With the HM Treasury Green Book non-traded central scenario priced at £70/tCO2e (~$90/tCO2), this means that compensation could be more expensive than the neutralisation options proposed, at least in the short term. Removal offsets based on -avoided nature- loss and nature-based sequestration projects currently cost $10-50/tCO2e, with variations between geographies and project types.

The current average price of afforestation/reforestation credits is around $8/tCO2e (2). There was much oversupply of carbon credits after international agreements for trading under the Kyoto Protocol stalled. The rules under the Paris Agreement have yet to be agreed and will be a key issue at COP26. Prices are expected to rise with increasing demand, especially if confidence in voluntary offset markets increases.

Nature based solutions do of course immense potential for co-benefits to biodiversity, ecosystem services, and local and indigenous communities’ livelihoods, but biogenic carbon storage has greater risk of being short duration than geologic storage. Realising the co-benefits is also highly dependent on programme design.

In the longer run technology-based removals are expected to sit between $100 to 200/tCO2e in 2030 (3). The UK Climate Change Committee Sixth Carbon Budget scenarios assumes an average cost of removals of around $130 (£100)/tCO2e for the 2030s and 40s but with a wide variation of costs between project types.

It will be interesting to see how compensation and neutralisation concepts play out, and how easily truly useful climate finance initiatives can be distinguished from greenwash. The SBTI are seeking feedback on a number of questions – what is an acceptable reference price? What quality and additionality criteria should be followed? What is the role of the SBTI in corporate finance commitments?

Final reflections

- The likely increase in scope 3 coverage and ambition is going to increase the complexity of measurement and disclosure. This will require better reporting and data solutions covering a diversity of different metrics, but all feeding into one central location to monitor what they mean on the pathway to net zero.

- Time is ticking for the SBTI’s ‘well below 2 degrees’ pathway – the 1.5D pathway is fast becoming the norm, as seen in the SBTI’s 2020 Progress Update.

- The SBTI is entering a new phase in which 1.5D SBTs will act as an interim step before a net zero commitment date. Real estate businesses with SBTs in place will need to consider where their existing targets take them, and what the gap is to net zero – most likely the hardest to abate areas. Those without an SBT already who want the status of an SBT ‘Net Zero’ commitment might find the requirements will toughen.

- Companies will need to better understand their options around compensation and neutralisation. COP26 will hopefully provide or precipitate clarity on how robust voluntary offset markets can work at scale to complement the SBTI’s net zero definition. Meanwhile, a process to standardise GHG accounting of carbon removals by corporates is being conducted by the GHG Protocol, with final guidance expected for release in early 2022.

- There will be a separate standard for financial institutions at a later stage. Asset owners and managers are included in this definition. A pilot version of the guidance is available, published last October. This uses an intensity basis for target setting, following the Sectoral Decarbonization Approach (SDA) – more complicated than an absolute reduction target. With few real estate companies going down this route at the moment, will this guidance be more relevant to other investment asset classes going forward, such as mortgages?

The SBTI’s consultation runs until February 26th 2021.

For support in understanding the SBTI’s draft requirements, the SBT process more widely or any other queries on the journey to net zero real estate please contact Adam Smith, Head of ‘Aim for Zero’ Real Estate.