The world is changing

More investors want proof of Paris-alignment and decarbonisation’s financial upsides. The Science Based Target Initiative (SBTi) requirements

are moving to absolute Scope 3 cuts for companies, and portfolio absolute emissions cuts for investors.

Why Aim for zero

-

1Value

Delivering on targets aligned with 1.5°C attracts higher valuation premiums.

-

2Shield

Pre-empt carbon exposed downsides, uncertain transition related regulations and disclosures.

-

3Timely

Start soon on the harder, longer-term decarbonisation measures, to meet the Science Based Target (SBT) and Return on Investment (ROI).

-

4Capital

Demonstrate commitment to sustainability and attract Environmental Social Governance (ESG) focused capital from Limited Partners (LPs).

-

5Autonomy

Building capacity for portfolio companies to be independent in delivering decarbonisation reduces demand on advisors and PE firms.

Services to help you aim for zero

We cut through the complexity of target-setting so your stakeholders can own decarbonisation. We set SBT-aligned or SBTi-validated targets with clear implementation roadmaps, leaving you with:

1. Simple trackers and playbooks for all stakeholders to understand the targets and progress to meeting them.

2. A library of costed decarbonisation measures so that each portfolio company knows how to meet the targets and the ROI for doing so.

3. Education sessions to further accelerate deal teams and portfolio leadership to deliver decarbonisation linked value creation.

This results in PE firms moving from targets being a strategic idea to a day-to-day practice in unlocking value across evolving portfolios.

This bespoke service might include

Risk screening. Map exposure to physical and transition risks across various scenarios, highlighting vulnerabilities and opportunities.

Target feasibility. Understand financial, practical and risk implications for portfolio companies and PE firms to meet targets.

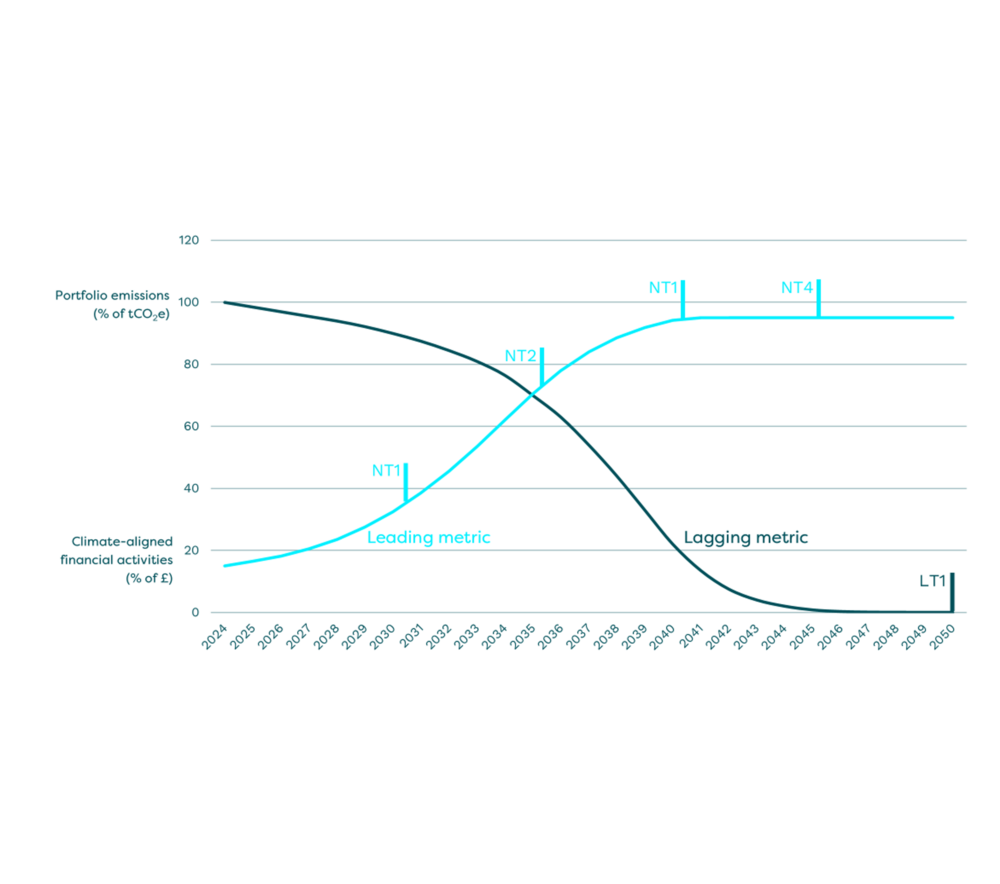

Target modelling. Develop target trackers, segment fossil fuel exposure, agree target ambitions with key stakeholders.

Validation support. Preparation to avoid pitfalls in target validation, hand holding through every review round from the SBTi.

Decarbonisation playbooks. A non-jargon guide for how to achieve SBTs for portfolio companies and investment managers.

Lever libraries. Sector-specific decarbonisation measures with CapEx, OpEx, Payback data, how to pull the lever, difficulty, etc.

Education support. Portfolio companies and/or investment managers gain a fundamental understanding of SBT ROI.