The FINZ standard for PE

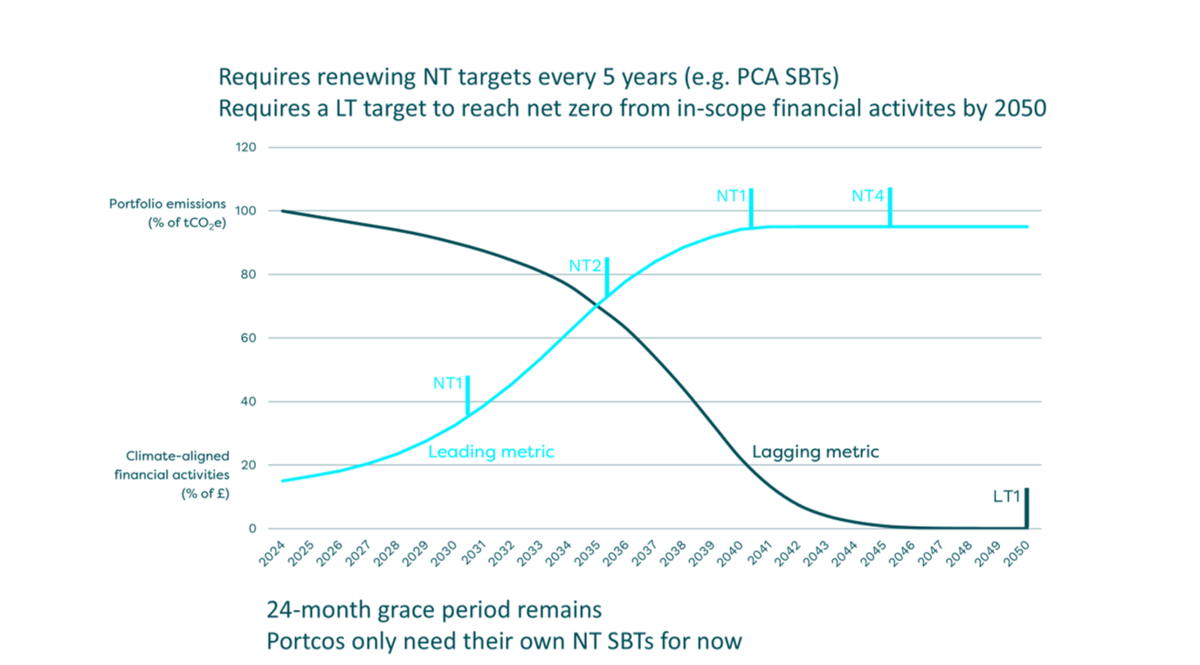

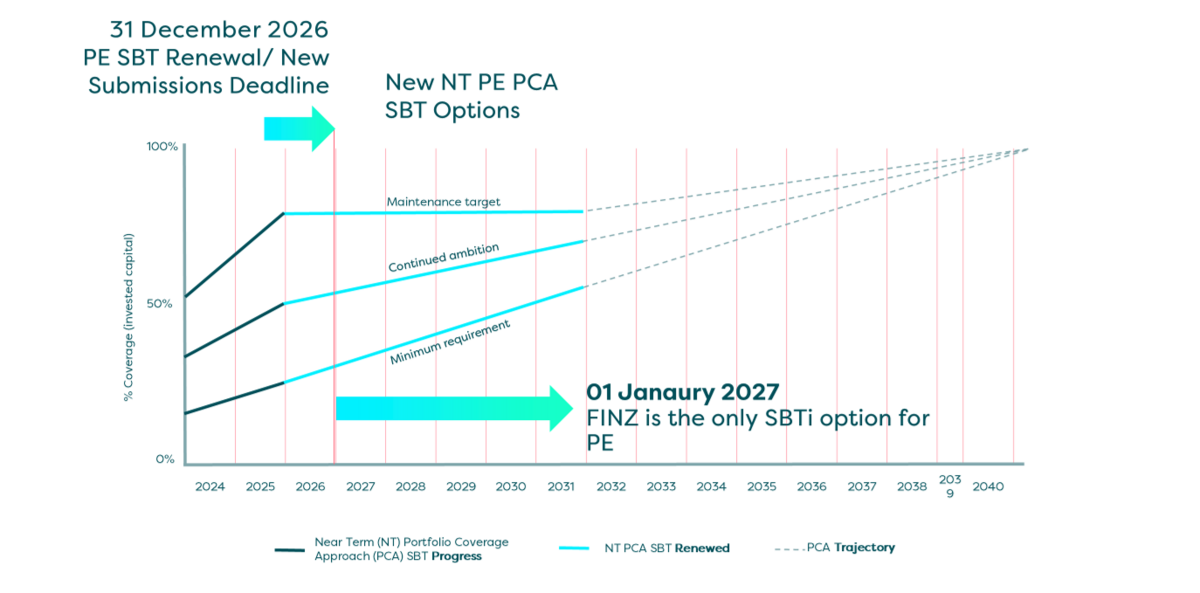

From early 2026 private equity (PE) will need to consider whether to renew PE SBTs or to use the FINZ Standard. The window for a considered choice closes in 2026, leaving PE with only the FINZ option thereafter.

This article helps you navigate that decision and de-mystify FINZ for PE.

Article summary

FINZ is pushing PE to navigate funding transformational change whilst protecting IRR through decarbonisation.

PE needs to confront life beyond the quick wins. Many portcos have already captured the easy wins, the high-return, low-CapEx decarbonisation levers. FINZ ultimately means portfolios must tackle the hard, capital-intensive projects.

There are three key actionable next steps:

1. Conduct a FINZ readiness assessment. Compare the implications of a PE SBT vs. a FINZ pathway.

2. Understand the financial feasibility of each option for your portcos.

3. Renew your PE SBT or adopt FINZ by the final deadline of 31st December 2026.

The Hurdle Isn't the Rulebook. It's the Execution.

Peel back the dimensions of the new SBTi FINZ Standard, and the core message for Private Equity (PE) is surprisingly clear. The real challenge it unveils is the issue of financing the next wave of decarbonisation.

Seven essential takeaways for PE from the FINZ Standard

- Renew your portfolio coverage targets every five years

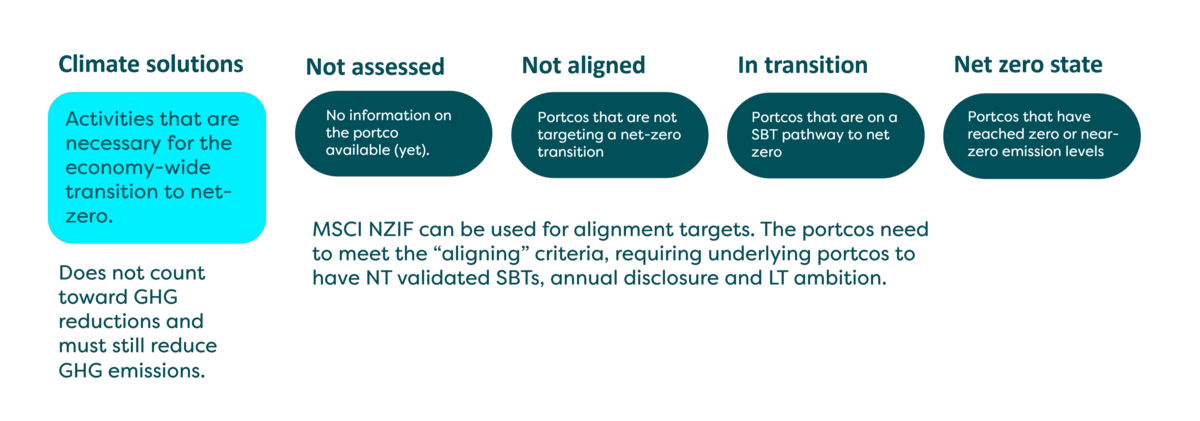

- Ensure your portfolio companies (portcos) meet their own SBTs

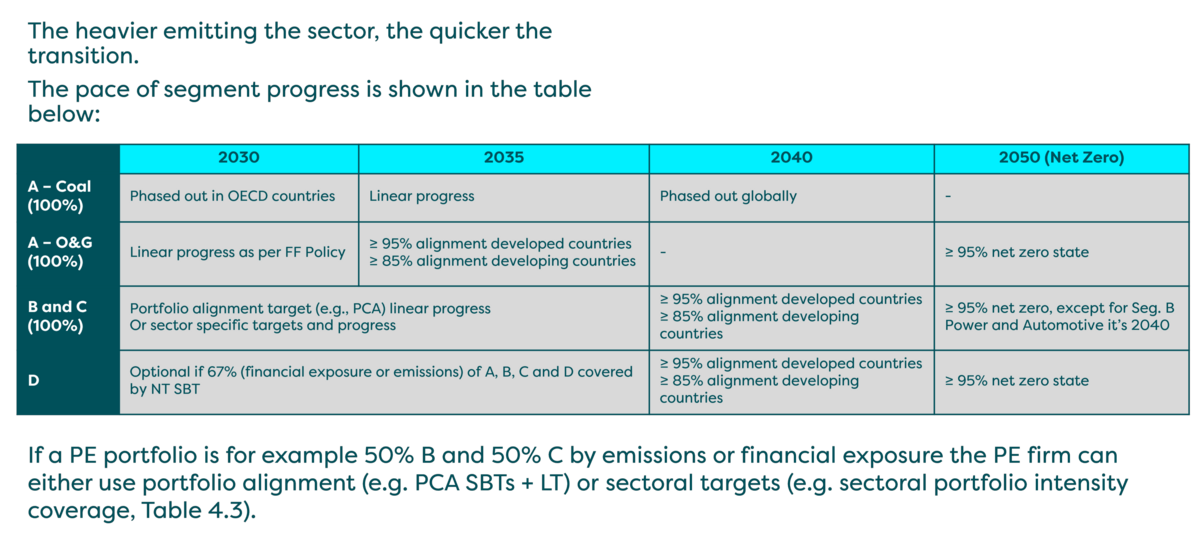

- Ensure the heaviest emitting sectors reduce their emissions quickest

- Start aggregating more portfolio GHG data

- Prepare for deforestation data requirements from 2030

- Publish a policy on fossil fuels

- Set a Long-Term (LT) target to reach net-zero by 2050.

The hurdle for PE isn't FINZ itself, in fact, PE has one of the most manageable pathways of any Financial Institution (FI).

The real, enduring challenge is figuring out how to finance and implement deeper decarbonisation while meeting return hurdles.

FINZ is simply the mechanism pushing the entire market to finally account for deeper decarbonisation.

Moving companies to a net zero state is the big hedge that any PE firm is signing up to with FINZ. See Decarbonisation CapEx Gap Article here that provides valuable insight into the deeper financial implications for the next era of decarbonisation.

Cutting Through the Complexity

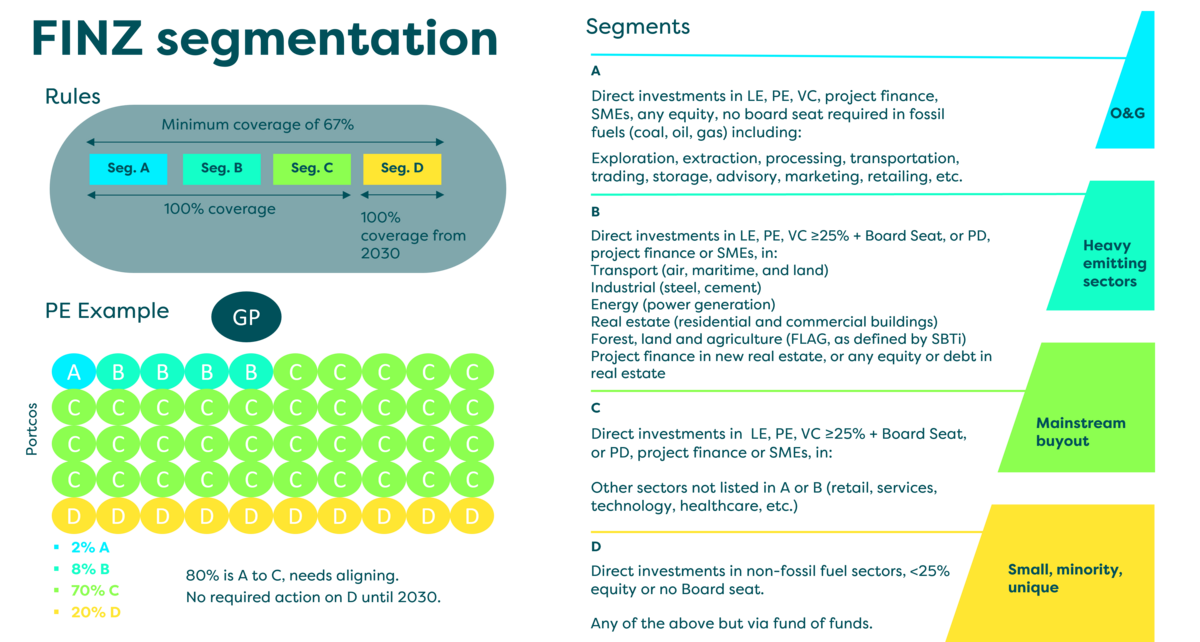

The standard introduces a segmentation model (A-D) that dictates the pace. Here’s the operational reality for your portfolio:

- If you have investments in Segments A, B, or C you must set targets covering 100% of these segments. The rule is simple, the heavier the emissions, the quicker the transition.

- If you have investments in Segment D (e.g., via fund of funds, or minority stakes in non-fossil fuel sectors) the requirement is simple, you only need to set targets for Segment D if your combined coverage of Segments A, B, C, and D is less than 67%. If you already meet the 67% threshold without Segment D, you can do very little on it until 2030, with a full deadline of 2050. This provides a significant grace period for the part of your portfolio where influence and/or impact is limited.

The Inevitable Squeeze

FINZ doesn’t create a new problem; it forces the market to confront an existing one. Many portcos have already captured the easy wins, the high-return, low-CapEx decarbonisation levers.

The next decade will be defined by the harder, capital-intensive projects. FINZ, alongside upcoming standards like the SBTi Corporate Net-Zero Standard V02, makes tackling these complex projects a non-negotiable part of long-term value creation and protecting exit premiums.

The question shifts from if to how you will finance this transition without compromising returns.

Actionable Steps

FINZ is a fundamental strategic decision about your firm's near and long term stance on value, risk and reputation. PE firms should consider:

1. Conducting a FINZ Readiness Assessment. This is the first step. Don't commit to a full validation process prematurely. Instead, simulate a new PE SBT vs. a FINZ pathway side-by-side to understand the exact implications for your specific portfolio. A strategic assessment should provide:

- A Modelled View: What would a credible FINZ ambition look like for your current portfolio mix? How does it compare to a renewed PE SBT?

- A Pragmatic Gap Analysis: What is the effort, cost, and risks against key FINZ requirements (e.g., fossil fuel policy, data readiness for different segments)?

- Strategic Recommendations: An evidence-based recommendation on the optimal route for your firm based on strategic fit and operational practicality.

2. Use Data to De-Risk the Decision. Leverage any existing costed decarbonisation analysis you have on your portcos. Understanding the financial feasibility of the required emissions reductions is what separates a credible target from an unachievable one. This moves the conversation from "what's the target?" to "how do we hit it?"

3. Choose Your Pathway with Confidence.

- If you renew the PE SBT: You are opting for a known quantity with a proven track record. This is a pragmatic choice for firms focused on continuity and managing internal resource.

- If you adopt FINZ: You are making a forward-looking statement, aligning with the latest standard and potentially future-proofing your strategy. This is a strong choice for firms with significant Segment B exposure or those wanting to lead.

The Bottom Line

The deadline of 31st December 2026 for PE SBT renewals is not that far away. The window for making a considered choice is in the next quarter, Q1 2026.

The firms that will succeed are those that treat this not as an administrative hurdle, but as a strategic exercise to de-risk their path to net-zero and align their portfolio with the inevitable transition.

Facing the renew-or-switch decision? Our FINZ Readiness Assessment is designed to provide the clarity you need, turning uncertainty into a confident 2026 strategy.

Download BIP.Verco's detailed FINZ Guide