The decarbonisation CapEx Gap

Companies must solve the capital-allocation issue in delivering on net zero targets.

This article outlines the CapEx challenge and considerations for your capital planning to protect IRR.

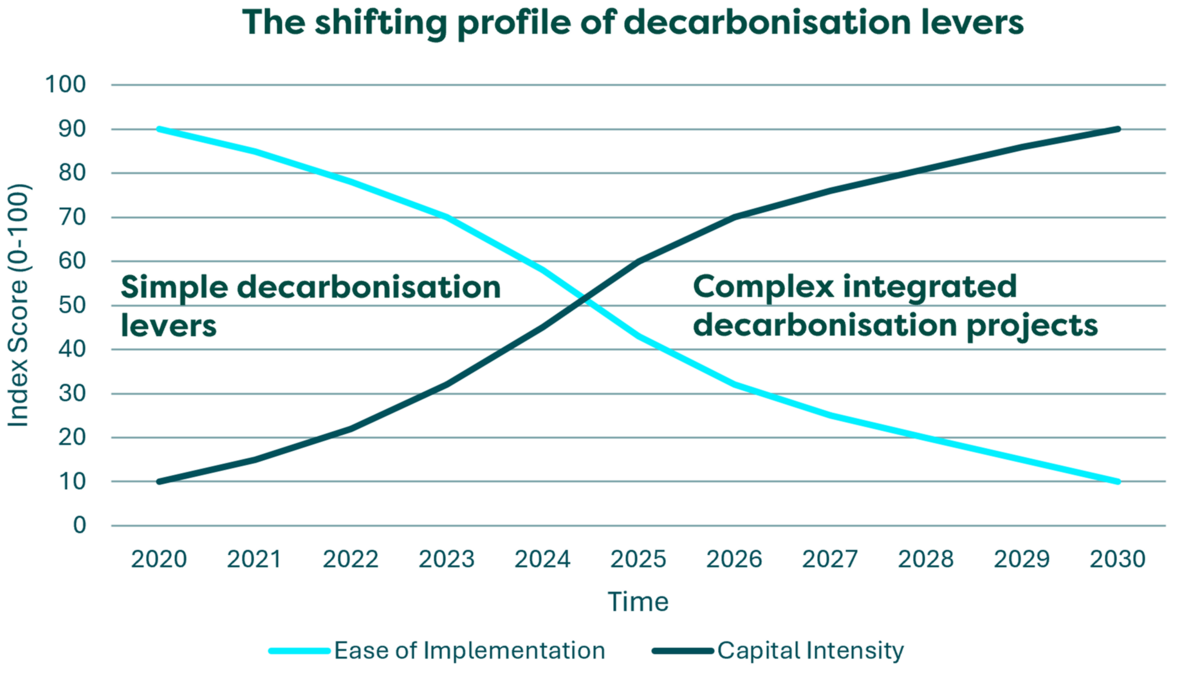

Your portcos' SBTs will take more than just the fast depleting high-return singular decarbonisation levers to meet the targets. What remains are more complicated, capital-intensive decarbonisation projects, that do not always have the same IRR. The consequence of this dynamic is that many are walking into a CapEx liability and a direct threat to value creation.

Summary of things you can do to overcome the CapEx Gap

- Move away from isolated decarbonisation initiatives and towards strategic capital planning of holistic decarbonisation projects.

- Map project types against natural investment cycles in three buckets; off-the-shelf (EV, Solar), integrated solutions (combine retrofits with upgrades) and R&D solutions.

- For priority decarbonisation projects build site feasibility level project investment plans and begin with hands on execution monitoring ROI.

Read on for further detail...

The decarbonisation CapEx gap

The low-hanging fruit for decarbonisation are depleting. The companies that will thrive are those treating decarbonisation not as a sustainability project, but as a core, integrated component of their financial planning.

It’s inevitable that companies will face slower returns, bigger bets, and longer timelines on decarbonisation. While many grapple with challenges like AI, supply chains and talent, decarbonisation is fundamentally changing. What was once the ‘easy’ part, quick wins like LEDs, renewables, and fuel switching that delivered fast returns, are becoming largely exhausted.

We are now entering an era where the path to absolute emissions reduction gets harder. The projects that provide the decarbonisation impact needed such as, deep building retrofits, low-carbon thermal energy, and complex process energy integration and/or electrification, are often CapEx-heavy, operationally complex, and feature longer payback periods.

This is a material consideration for many CFOs, a CapEx liability issue for their future balance sheets. The critical question, is it in your 3-7 year plan?

The Illusion of Progress

The proliferation of net-zero targets has created an illusion of progress. Setting a target was the starting gun, not the finish line. The central challenge is no longer ambition, but solving the capital-allocation puzzle.

Most corporate target-setting failed to model the financial reality of this next phase. This has created an implementation issue characterised by four intersecting challenges:

Degrading IRR . The most cost-effective levers are deployed. The remaining opportunities require significant upfront CapEx for longer-term savings, resulting in IRRs that struggle to compete for capital within traditional corporate hurdle rates if implemented alone.

Execution deficit. Companies lack experience identifying and executing complex solutions like heat decarbonisation or process changes. They have a strategy, but no pipeline of vetted, engineer-ready projects.

Capital allocation. According to the 2025 TPI Report, only 0.5% of public companies have CapEx and decarbonisation goals aligned.

Policy and Enabling Uncertainty. Companies often face a choice between paths like electrification or alternative fuels without the necessary policy certainty or enabling infrastructure. In operations with high heat usage, for example, the grid may lack capacity for electrification, while alternative fuel markets or financing instruments are underdeveloped. Critically, these final steps often combine significant CapEx with higher operating costs, making a standalone business case extremely difficult to prove.

Decarbonisation is not baked into core financial planning for many companies across these three implementation issues, that is reducing the funding that is going into decarbonisation and creating the CapEx gap.

Integrated Decarbonisation Projects

The bigger shift that many are missing is the need for holistic, integrated projects that fit into your company’s longer-term asset renewal and servicing strategy.

Moving away from just considering isolated ‘decarbonisation levers’ and moving toward strategic capital planning with ‘decarbonisation projects’.

Projects are where multiple decarbonisation levers are identified, designed, costed and executed in conjunction, to drive more attractive returns whilst also meeting target commitments.

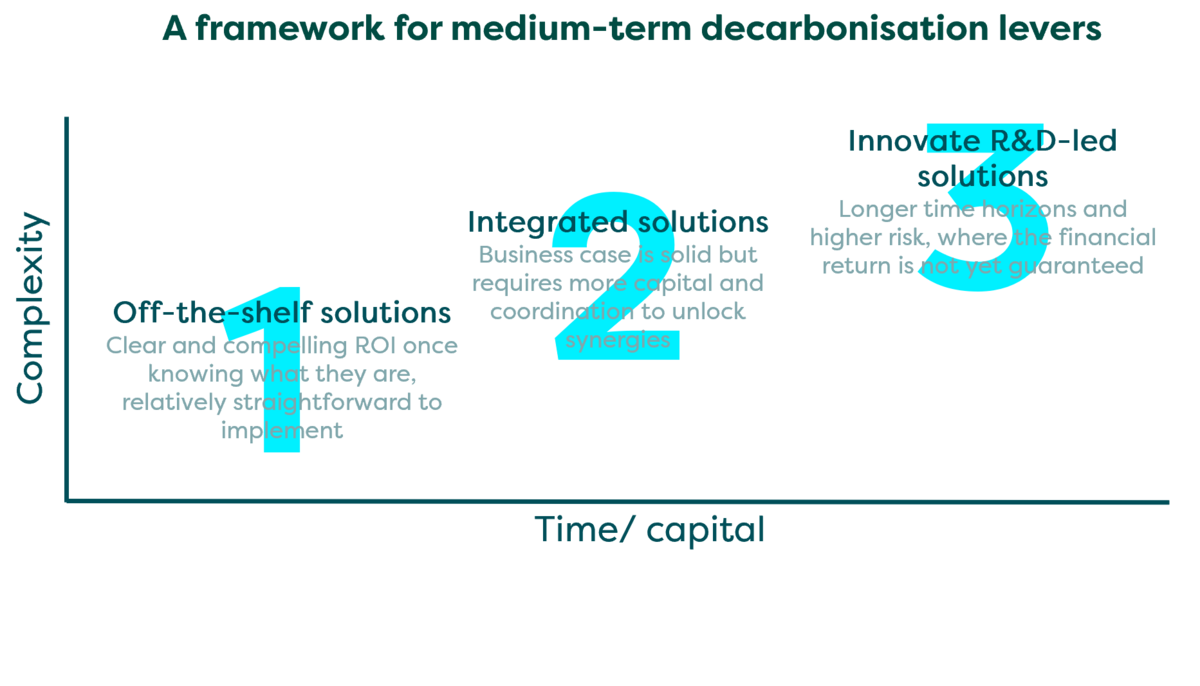

To explain this differentiating, think of your abatement pipeline in three layers, mapped against your natural investment cycles.

Tier 1. Off-the-shelf solutions - such as EVs and solar

- These are proven but require significant capital. The key is strategic timing around asset renewal to avoid sub-optimal, piecemeal investments.

Tier 2. Integrated solutions - such as combining a building retrofit with heat pump installation

- These projects create synergies, delivering a bigger impact for less incremental cost. They require careful planning but offer a more compelling business case by bundling CapEx.

Tier 3. R&D-led solutions - such as process innovation, green hydrogen pilots

- These are longer-term strategic investments for transforming core business models. They carry higher risk but are essential for future-proofing in hard-to-abate sectors and can often attract grant funding or other forms of strategic finance.

Acting on Tier 2 thus helps to close the CapEx gap, with projects that protect IRR from decarbonisation but Tier 2 is not about doing everything at once.

The business case for both Tier 1 and 2 measures becomes compelling when executed at the point of reinvestment, i.e. around asset replacement cycles.

A 3-to-7-year capital planning window is then not a constraint, it’s the opportunity to capitalise on these plans.

Execution is Critical

The question is no longer what you have pledged, but how you will deliver. Strategies alone are not enough. Companies must move from ambition to executional excellence by:

- Integrating decarbonisation into core strategy, treating it as a financial imperative.

- Building detailed, costed roadmaps that align decarbonisation CapEx with asset renewal cycles.

- Developing a robust pipeline of projects, moving from accounting to engineering and implementation.

- Crucially, companies must be able to develop and procure these projects effectively to ensure carbon and financial returns are delivered. This requires a dedicated focus on implementation, often supported by trusted partners and experts who can provide the necessary skills and experience.

Tracking financial ROI and proving progress to stakeholders with reliable data is essential.

It is critical that companies have a credible, funded decarbonisation plan to avoid a pending CapEx liability, something a CFO or any future investor would struggle with.

About BIP.Verco

BIP.Verco helps companies navigate the decarbonisation CapEx gap. We combine decades of project experience with data-driven software to turn decarbonisation from a cost into a driver of ROI, building resilience and creating value without degrading IRR.