Climate risks in real estate: what asset managers need to know

How should physical climate risks be assessed?

The EU Taxonomy, serving as a classification system for sustainable investments, offers a clear and detailed framework for assessing physical climate risks in real estate. It is particularly important for compliance with the Corporate Sustainability Reporting Directive (CSRD) and the Sustainable Finance Disclosure Regulation (SFDR).

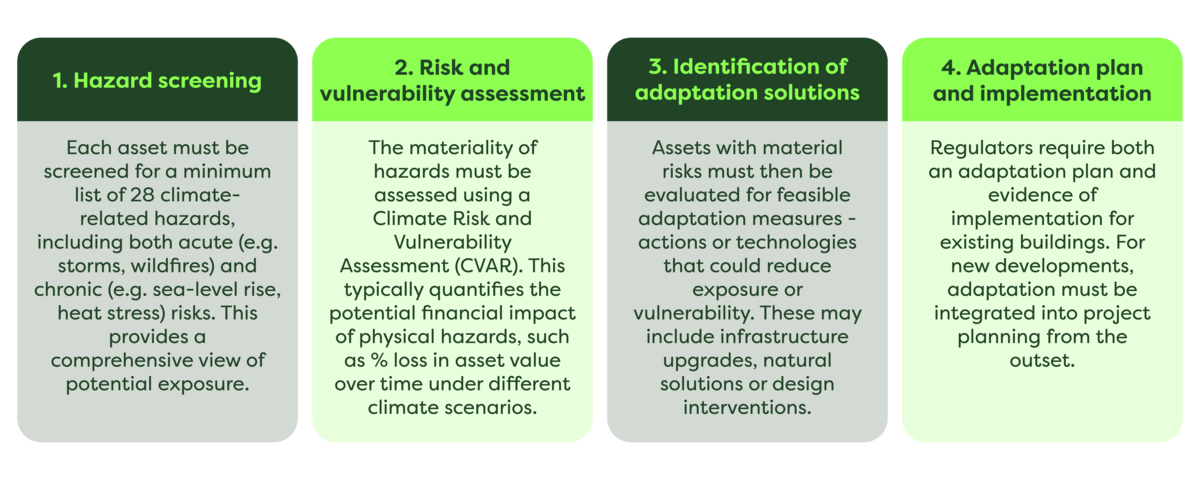

The EU Taxonomy outlines a four-step process:

Importantly, these assessments must be underpinned by IPCC-compliant, state-of-the-art modelling, using robust scientific data, several climate scenarios and multiple time horizons. The Task Force on Climate-related Financial Disclosures (TCFD) and BBP both recommend using at least two climate scenarios, these usually include a “business-as-usual” case and a medium-mitigation pathway.

The approach is also shifting from carbon-only scenarios (RCPs) to more socio-economic pathways (SSPs), providing a richer, context-driven understanding of future risks.

How are real estate professionals managing the complexity of climate risk modelling?

Most asset managers, by default, turn to third-party assessment platforms. However, the feedback from BIP.Verco’s clients is that the landscape of providers and offerings is often complex and confusing with a lack of quality and consistency of data, assumptions and sources, underlined by the fact that different tools are found to sometimes highlight very different risks for a specific site.

Common concerns include:

- Overly diagnostic outputs: Platforms provide extensive risk data, but little prioritisation or actionable insight.

Lack of financial integration: Outputs are often not linked to tangible metrics like retrofit CAPEX or insurance premiums.

Missing adaptation pathways: Most tools do not offer practical, implementable adaptation solutions tailored to individual assets.

This has led many asset owners to either switch platforms or engage consultants with deeper climate expertise to interpret results and translate them into strategy.

BIP.Verco can help: Our in-depth platform review highlights market trends and gaps

The BIP.Verco team conducted a market review of 26 platforms, then explored 7 ones via demo calls and trial tested the chosen top fiive. This allowed us to identify several key market trends, which are detailed in the report linked below.

We have a proven track record in enhancing assets’ climate resilience by applying industry best practices and actionable strategies informed by deep expertise. We continuously monitor platform developments, test tools internally, and deliver insights grounded in best-practice science and regulation. Our dedicated team of engineers specialise in net zero audits and are well-equipped to assess sites and deliver costed adaptation solutions.

For further support, or a tailored climate risk assessment, please contact: