The world is changing

LPs are demanding more than just annual ESG reports. They require real-time proof of decarbonisation's financial upside and comprehensive ESG performance data. ESG regulations and frameworks are becoming more convoluted and demanding,

Our Report for Zero service provides the specialised expertise and resources to successfully navigate these complex requirements.

Why report for zero

-

1Transparency

Directly link carbon cuts to financial KPIs for a clear line of sight between sustainability and profitability.

-

2Automated

AI-driven dashboards that auto-generate ROI and carbon reports, freeing up resources and ensuring accuracy.

-

3Trust

Communicate decarbonisation performance effectively to stakeholders, building trust and credibility.

-

4Pro-active

AI-powered anomaly detection flags potential issues before they impact OpEx, enabling proactive intervention.

-

5Data-driven

Access a global database of verified projects with CapEx, OpEx, and ROI data, eliminating guesswork and enabling data-driven decisions to prioritise measures/ projects.

How we help

MyVerco provides ESG reporting services in:

1. Creation of customised fund reports for LPs on decarbonisation.

2. Live tracking of target GHG emissions and financial progress across portfolio companies and/or assets within portfolio companies

This bespoke service might include

Climate Reporting. Technical preparation of reports to industry standards with recommendations to close gaps to best practice.

MyPerformance. AI-driven anomaly detection identifies operational inefficiencies driving immediate and longer term cost savings.

MyProjects. Access to a database of costed decarbonisation levers with ROI data, enabling data-driven project prioritisation.

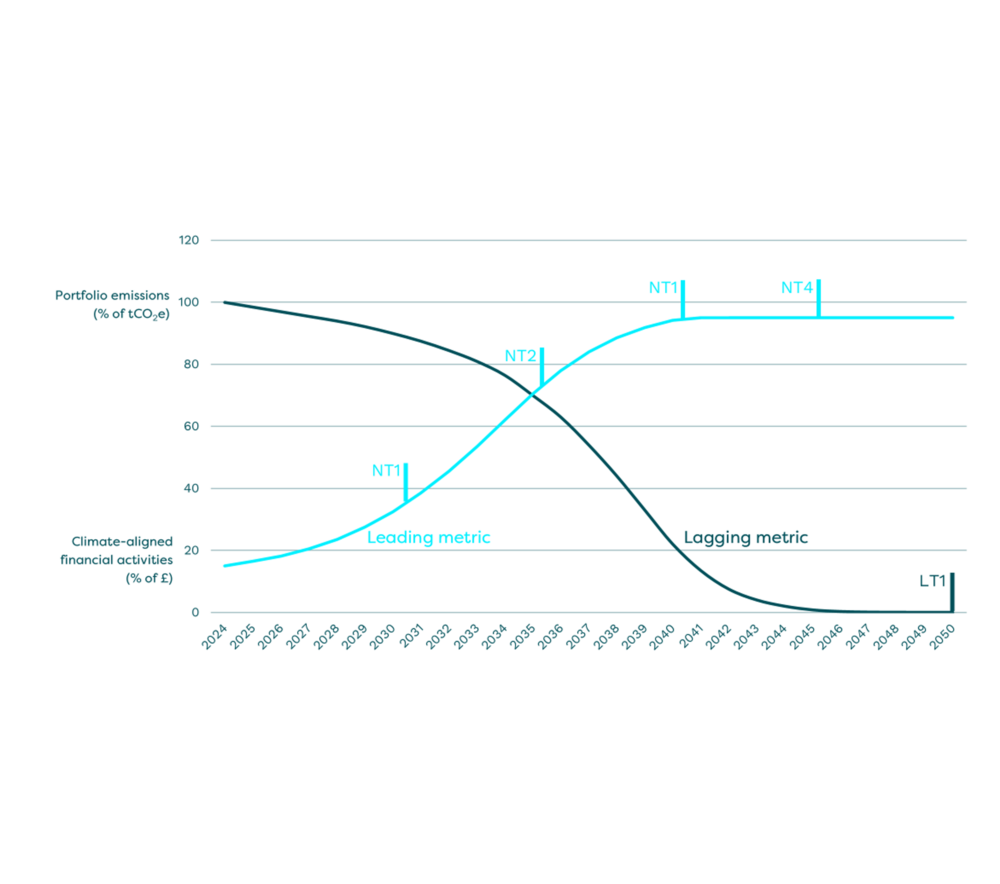

MyPathways. Live tracking against SBTs/FINZ targets provides real-time visibility into progress and enables course correction.

Portfolio View. Consolidate asset level information to central and strategic stakeholder reporting with automated reporting.

Asset Heatmap. A map of all assets showing how close each asset is to Net Zero with the required capital and timeline to meet targets.