The complete guide CSRD and ESRS, article 2 of 2: Reporting CSRD and ESRS: when, what, and how

In this article, Amy Hodgson, Consultant describes when the European Sustainability Reporting Standards (ESRS) requirements will come into effect, what you should report on and how you should do this. She also gives useful next step actions to meet the requirements. For a useful overview of the Corporate Sustainability Reporting Directive (CSRD) and ESRS, read the first article in this two-part series here.

ESRS background.

The ESRS were developed by the European Financial Reporting Advisory Group (EFRAG) and were adopted in August 2023. They are enforced by the Corporate Sustainability Reporting Directive, the legislative mechanism, which came into effect on 1st January 2024.

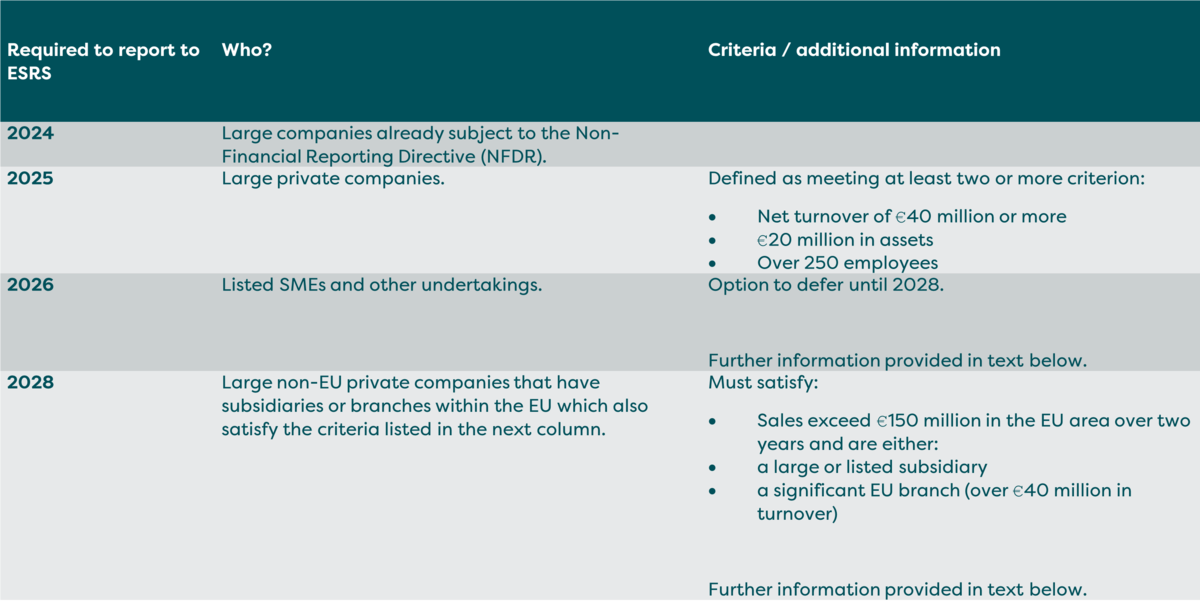

Reporting timeline for ESRS.

The CSRD significantly increases the level of required disclosures, and it is expected that the number of companies mandated to comply to the directive and report on ESRS, will increase from 11,700 to 50,000 companies, when fully implemented.

The enforcement of the ESRS will follow a four-year phased approach. Larger companies will be required to report sooner in comparison to their smaller counterparts. All companies, having been subjected to comply, must continue to report on an annual basis.

The phased timeline on who is subject to report to CSRD via ESRS is detailed below.

Listed Small and Medium Sized Enterprises (SMEs) are expected to report in 2027 on 2026 annual data.

The scope for Listed SMEs is still subject to change, with a less intensive set of standards being finalised by EFRAG.

Who must report

The ESRS standards potentially apply to all companies with operations in the EU; therefore, they will be applicable and compulsory to companies within the Real Estate industry. It is beneficial to understand when your company will be in scope of the ESRS and what you will be required to report on.

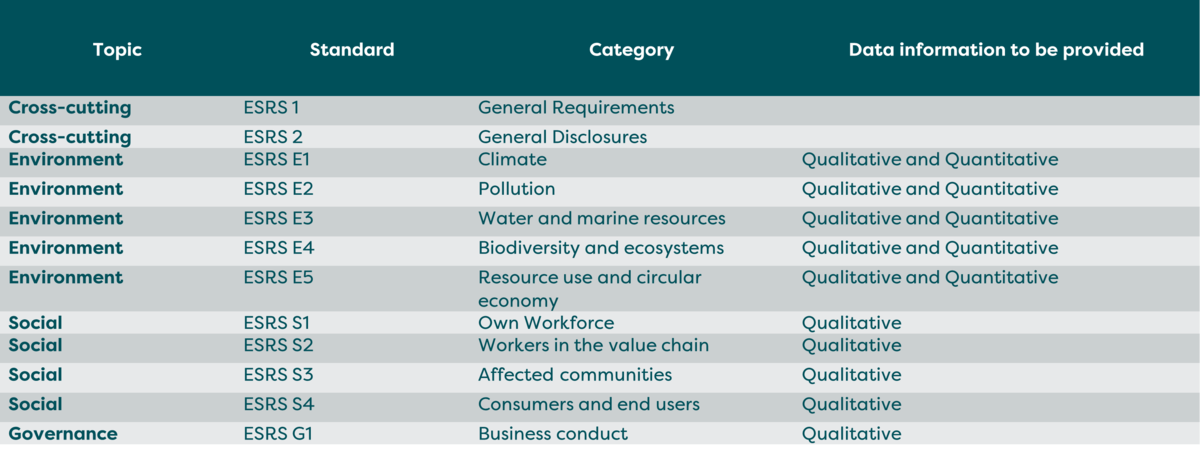

What you must report on: The 12 ESRS standards have two categories.

The ESRS obliges companies to disclose the risks and opportunities they see arising from social and environmental issues, as well as the impact of their activities on society and the environment; of which, all must be assured. This approach aims to bring the quality of disclosed environmental information to the same standards as disclosed financial information. All the 12 standards consider discussions held by the International Sustainability Standards Board (ISSB) and the Global Reporting Initiative (GRI), to ensure interoperability between EU and global regulations and to avoid double counting.

There are 12 ESRS standards which have two categories:

1. Cross cutting (there are two of these).

The general standards (ESR1 and ESR2) are cross-cutting, meaning they will be compulsory for all companies in scope, regardless of size, revenue and geography. They deal with concepts such as double materiality, reporting on the value chain, and how information should be gathered.

General Requirements - ESRS 1: states the mandatory principles and concepts that must be applied when preparing sustainability statements under the CSRD. ESRS 1 requires companies in scope to disclose certain sustainability information irrespective of the companies’ judgement of their materiality; including information on governance, strategy, management of impacts risks and opportunities, metrics and targets related to climate change.

General Disclosures - ESRS 2: provides information on the specific disclosure requirements for the preparation of the sustainability statement. This includes general characteristics of the company and an overview of their business, but also specific disclosures on compliance such as approximations in relation to value chain and boundaries, estimation uncertainty, changes in preparation and presentation, and prior period errors. Additionally, information around strategy, governance, and the materiality assessment of sustainability impact, risks and opportunity are covered by ESRS 2.

2. Specific (there are 10 of these which relate to either environment, social or governance elements).

The 10 more specific and unique standards will be disclosed on a per company basis. To work out which specific standards you need to report on, you will need to do double materiality assessments. ESRS is unique in the sense that both impact and financial materiality assessments must be undertaken for the company to understand which of the 10 more specific standards it is required to report on.

Double Materiality means a company must analyse two types of materiality - financial and impact.

- Financial materiality includes how environmental and social events could cause financial risk and impact for the company itself. The Task Force on Climate-Related Financial Disclosures (TCFD), International Sustainability Standards Board (ISSB) and International Financial Reporting Standards (IFRS) follow financial materiality assessments.

- Impact materiality includes understanding the significant impacts a company has on the environment, people and society in general. The Global Reporting Initiative follows an impact materiality assessment.

It’s likely that you will need to report on the majority, if not all, of the standards if you are in the real estate sector.

The 12 standards.

How you should present your report.

All information should be issued in a Sustainability Statement and must be machine readable. The report must be created by using the European Single Electronic Format (ESEF).

All information must be clearly laid out and distinguished. Information that is captured from ESRS 1 should be clearly identified in a single section of the Management report and referred to as ‘Sustainability Statement’. All other information that is disclosed should be labelled in its own, clearly defined section.

Information that is reported due to other legislations or directives should be presented separately and distinctively, to indicate that the information is not in relation to the requirements of ESRS or CSRD.

An example of how the report could be ordered is listed below:

- General Information

- Environmental

- Social

- Governance

Key next steps:

- Identify if your company is already subject to report to CSRD and ESRS – with reporting starting in 2025 using the 2024 dataset.

- If not, understand when your company will be required to report.

- Review your current sustainability reporting approaches and practices: Highlight where there are potential gaps or missing data.

- Design a sustainability reporting strategy: If any gaps or weaknesses are identified, develop and implement a plan to address these gaps in order to start collecting the required data.

- Recognise, collect and analyse the required sustainability data: You will need to ensure that the data you are required to report on is accurate and reliable.

- Perform the double materiality check: this will identify which data your company must report on and assist with identifying material impacts, risks and opportunities.

If you would like any further guidance regarding CSRD and ESRS standards, or if you require help with any other sustainability reporting standards, please do contact a member of our expert team.

Services to help you.

Real Estate companies should begin sourcing the correct environmental, social and governance data needed to comply with ESRS and CSRD. Those who are proactive and identify key standards that they will be subject to disclose, will have an advantageous position against their peers and competitors.

We offer a number of services where we can support you with CSRD and ESRS standards. We can support you with gathering data, reporting, and assurance:

ESG data and reporting partner service

Sustainability assurance and verification