Pre-assurance: the key to having confidence in your ESG reporting

Non-financial reporting regulations and requirements are becoming more comprehensive in both scope and depth, with a clear push for sustainable data to be assured to the same standard as financial data.

These developments represent positive steps toward creating a robust, transparent, and holistic reporting environment for companies across all countries, industries, and markets. However, for organisations without the capacity, time, or expertise to navigate the increasingly complex world of environmental reporting, these changes can feel overwhelming.

At BIP.Verco, we partner with you to strengthen your team's expertise in ESG disclosure and regulatory reporting while enhancing the accuracy, integrity, and reliability of your data. Our goal is to ensure you approach critical deadlines with confidence in your processes and outcomes.

What are the problems and how can we help?

Often, we have clients come to us who are:

Confused as to where to start and how they can prepare for an upcoming and mandatory disclosure.

Unsure if they are providing enough quantitative and qualitative context to their mandated reporting – especially for a disclosure that is constantly changing its scope, such as CSRD.

Concerned about the cost of an assurance cycle and not feeling confident that their current reporting process(es) and outputs will result in a positive assurance outcome.

Unsure if there are any gaps in their methodologies, data management or analytical approaches which they could address in the meantime, ahead of an assurance cycle.

For clients like this, we recommend a pre-assurance service. Pre-assurance allows us to keep our “consultant” hats on, providing support and guidance, whilst looking at the problem through an ‘assurance’ lens.

What is pre-assurance?

Pre-assurance is an assessment that mirrors aspects of the assurance process, a ‘mock test’, as such. Companies often use it to test how close they are to being ready for formal assurance. The results of pre-assurance often include a Findings and Recommendations report that can give you best practice advice and highlight any gaps that need addressing to secure a positive compliance or assurance outcome.

What are the benefits of pre-assurance?

Pre-assurance is a cost-effective way to streamline and strengthen your reporting processes. It can be a great starting point to better understand where capacity, budget and upskilling should be targeted. Pre-assurance allows our team to keep our “consultant” hats on, meaning we will be available to answer any of your questions, no matter how big or small.

From our 30 years of experience, our team has extensive knowledge on a wide range of non-financial reporting regulations, which places us in a strong position to support you through the complexities of sustainability reporting. We can highlight where there are gaps in datasets or methodologies and provide expert advice on how to produce a valuable, high-quality and credible reporting output.

Pre-assurance offers opportunity to re-align your processes to best practice. By doing this, it creates a reliable reporting system with representative and accurate outputs, essential to sustainable business strategy.

If pre-assurance is performed well, it can lead to a streamlined, positive and valuable assurance outcome.

In this article, we will address how pre-assurance can support with two key areas:

- Alignment to specific disclosures and regulations in order to reach compliance.

- Ensuring that current processes are following best practice and that no material data points are being omitted.

A helping hand when it comes to environmental reporting

As bigger and bolder environmental reporting disclosures are coming into effect, companies are struggling to stay on top of the additional time, effort and upskilling involved to ensure that final outputs are aligned and compliant to the disclosure or standard in question. To add to this, many disclosures and standards are introducing limited assurance requirements, with focus on the quantitative data for now, but increasing the scope to include qualitative information in time.

At BIP.Verco, we have in-depth knowledge on a wide range of disclosures and standards. Some of these already mandate limited assurance on reported data (especially on the quantitative data). However, there is a strong expectation that more regulations will follow suit in the coming years:

Corporate Sustainability Reporting Disclosure (CSRD) – limited assurance is required, with an expectation that this will move to reasonable assurance in future.

UK Sustainability Reporting Standards (UK SRS) – limited assurance requirements are expected in future years.

GRESB – limited assurance is voluntary, but it results in higher scoring.

Streamlined Energy and Carbon Reporting (SECR) – limited assurance is voluntary but recommended.

Australian Sustainability Reporting Standards (ASRS)- limited assurance requirements are expected in future years.

If we take CSRD as an example, there are potentially 1100 data points that a company could be mandated to report on. This large amount of quantitative and qualitative information, coupled with the uncertainty of the omnibuses, creates a confusing spiderweb of disclosure requirements that can be difficult to manage.

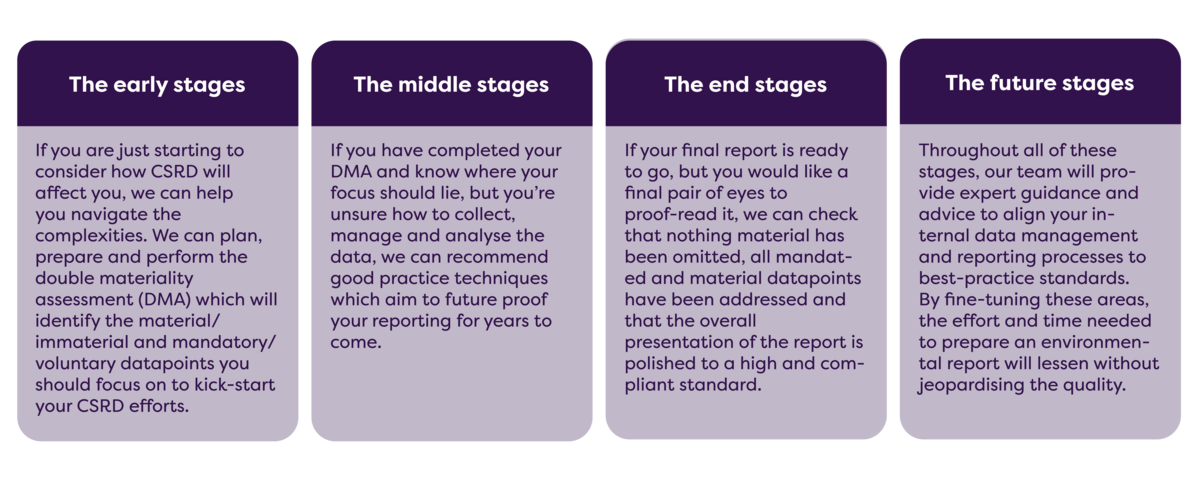

BIP.Verco can join you at any stage of your CSRD journey.

Reviewing processes

One of the difficult and often overlooked parts of the environmental reporting cycle is understanding if there are any data gaps that need closing, process improvement opportunities, or if the quality of the disclosed data and information is to an accurate, reliable and high standard.

Through pre-assurance, BIP.Verco can provide as much feedback as you need on your data and internal processes. We can perform a high-level review or a deep-dive into each stage of the reporting cycle, from data collection to report presentation. We will comment on anything that may jeopardise the likelihood of a successful formal assurance outcome. As a result, you can go into your assurance cycle feeling positive and prepared.

If from our review, we identify gaps or flawed practices, we can detail any minor and major findings and offer actionable next steps that you can focus on and implement ahead of the next reporting cycle. Not only will this create robust and trustworthy reporting practices, but it will ensure that money, time and efforts are not wasted on preparing for an assurance cycle that may not result in a positive outcome.

A unique advantage

Pre-assurance offers a unique advantage: feedback from experts who specialise in non-financial disclosure, have extensive experience in environmental formal assurance and recommend best practice approaches every day. This means preparing you for formal assurance cycles isn't just what we do—it's embedded in everything we deliver.

Find out more about the service